Accounting for Film Co-Financing Arrangement

BACKGROUND

One of the popular forms of a film financing arrangement involves a financing company or the investor and a studio (the Studio). The investor (the Company) is in the business of providing firm financing in exchange for expected returns. Generally, the investor finances an agreed-on percentage of film production cost. The Studio is responsible for film production using the financing provided by investor and, potentially, other sources. Following the completion of the production process, the Studio performs film distribution. The Studio receives financing proceeds from the investor and is therefore referred to as an investee.

The returns obtained from monetization of the film are distributed between the Studio, the investor and, potentially, other investors in accordance with the agreed-on distribution model.

The investor and the Studio sign an agreement governing various aspects of financing, production and distribution arrangement. Terms of the agreement specify roles and responsibilities of each party, some of which are described below.

Financing Terms: Investor Role and Responsibilities

An investor finances a film or more often a portfolio of films. As a funding assurance, the investor deposits agreed-on financing amount in the escrow deposit at the time of signing the agreement.

Terms of the agreement specify the type and percentage of film costs to be financed by the investor. Overall, investor’s share of production equity generally equals to its respective contribution to the final direct film production cost. The remaining share is financed by the Studio or other third-party investors.

Common terms of the agreement require that the Studio should consult with the investor on material marketing and distribution issues as well as production matters.

Financing Terms: Studio Role and Responsibilities

The Studio own copyright to co-financed films. Depending on specific terms, the Studio may have final say on specific production as well as distribution matters.

The Studio acts as a film distributor and, as such, receive gross distribution proceeds.

Allocation of Distribution Proceeds

Distribution receipts include money received from film licensing, home entertainment distribution, merchandising rights, etc. Both the Studio and the investor are entitled to receive their portion of gross receipts derived from the exploitation of the film. Allocation of proceeds between the two parties is determined by the order of priority stated in the contract. A standard order of priority may be as such that Studio first collects cash required to cover third party participations, product distribution expenses, production loans. The remaining balance may be split between the Studio and the investor proportionately to each party equity share in the film or other formula.

The investor may also be entitled to a management fee calculated by applying an agreed-on interest rate to cash balance kept in the escrow account.

Generally, the investor and the Studio are privately held companies. Some investors and studios prepare GAAP financial statements. Investors raised questions of how to account for

- investments made in films or film expenditure;

- film distribution proceeds received in return;

Studios raised a question of how to account for financing received from the investor.

The analysis in this publication assumes that a) the investor is not required to consolidate the investee and b) the investment is not in the scope of equity method of accounting. Detailed analysis of these matters is outside the scope of this publication.

GAAP GUIDANCE

ASC 606, Revenue from Contracts with Customers

ASC 808, Collaborative Arrangements

ASC 310, Receivables

ASC 320, Investments- Debt Securities

ASC 321, Investments- Equity Securities

ASC 325, Investments- Other

ASC 480, Distinguishing Liabilities from Equity

ASC 825-10, Financial Instruments

ASC 926-20, Other assets- Film Cost

ASC 946, Financial Services- Investment Companies

Non-authoritative guidance:

PwC Guide: Loans and Investments

EY Guide: Certain investments in debt and equity securities

EXECUTIVE SUMMARY

INVESTOR ACCOUNTING

Company’s investment in the film portfolio is not subject to ASC 606, Revenue from Contracts with Customers, as the Studio is not considered investor’s customer.

The financing arrangement signed between the investor and the Studio is not considered subject to ASC 808, Collaborative Arrangements, as, generally, the investor is not an active participant in the film development and distribution process.

The investment is not considered subject to ASC 926-20, Entertainment-Films-Other Assets-Film Costs, as the investor does not directly own any films, nor does it hold any film distribution rights as such rights are held by the Studio. Management believes that applying a “look-through” approach that would regard the investment as a direct investment in the film portfolio is not supported by GAAP.

Generally, companies investing in film portfolios are not registered under the Investment Company Act of 1940. However, if the entity is not regulated by the above act, it has certain fundamental characteristic and, potentially, meet other requirements. We are aware of certain instances that the investor was determined to be an investment company subject to ASC 946. In many cases, companies investing in films that have multiple investments and multiple investors will be considered investment companies while those that do not meet either of the above conditions are not considered investment companies subject to ASC 946. The determination of whether the company is considered an investment company depends on individual facts and circumstances of investor’s legal structure and operations.

The investment is not subject to ASC 325, Investments-Other, applicable to securitized beneficial interests as the investment is not considered a security.

The investment is not subject to ASC 320-10, Investments-Debt Securities as the investment is not considered a security.

To account for the investment, the investor may apply one of the following models:

Fair value option:

The investor may elect a fair value option as described in ASC 825-10, Financial Instruments- Overall and measure its investment in the film portfolio at fair value at each reporting date.

Amortized Cost less Impairment:

The investment can be subject to ASC 310, Receivables, applied by analogy, provided that the instrument is viewed as debt-like or a receivable balance. In this case, the investment is measured on an amortizable cost basis. Receivable balances are subject to impairment analysis. At the time of preparing this publication, the impairment is recognized when it is probable that a loss in value has occurred and the amount of can be reasonably estimated, according to ASC 450-20, Loss Contingencies (ASC 310-10-35-2 and 8). Receivables will be subject to current expected credit loss (CECL) impairment model applies upon adoption of ASC 326 or ASU 2016-13. Cash proceeds received from the payer are recorded as a settlement of the receivable balance, i.e., by debiting cash and crediting the carrying amount of receivable.

The investment may be subject to ASC 321, Investments-Equity Securities, provided the investment is considered an equity ownership interests. In this case, the investment will be subject to a different accounting treatment, including recording film distributions in investor’s income statement rather than a direct reduction of the carrying amount of the investment.

By applying equity vs. liability classification guidance provided in ASC 480 by analogy, the investments can be appropriately considered as receivable-like or the investment in debt rather than the investment in equity. Therefore, we believe that the investment should be accounted for using guidance per ASC 310, Receivables. The above conclusion involves substantial amount of judgement and reporting entities should carefully examine relevant facts and circumstances and consult with their accounting advisors to establish proper accounting treatment.

STUDIO ACCOUNTING

Generally, we believe that the financing proceeds provided by the investor are considered studios assets and should be recorded on its balance sheet. However, certain terms and conditions impacting studio’s rights and obligations associated with the funds kept in the escrow account may override the conclusion that the investment proceeds are considered studio’s assets. The conclusion may change if the assets in question are not subject to claims of studio creditors. Studios should carefully analyze the terms associated with financing proceeds and consult their advisors to establish proper accounting treatment.

ANALYSIS

Question 1: Are distribution proceeds received from exploitation of the film subject to ASC 606?

ASC 606 specifically applies to contract customers defined as “a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration goods or services that are an output of entity’s ordinary business activities” (ASC 606-10-20, Glossary). Revenue from transactions or events that does not arise from a contract with a customer is not in the scope of the revenue standard and should continue to be recognized in accordance with other standards.

ASC 808-10-55-15 provides an example of two studios collaborating on the project involving production and distribution of a film. Studio A will manage the day-to-day production activities and will be responsible for distribution in the U.S. Studio B will be responsible for distribution in Europe and Asia. Both studios will share equally production costs and profits.

Both studios concluded that the above collaborative arrangement is not subject to ASC 606 because the arrangement does not involve relations with a customer (ASC 808-10-55-17 and 18).

Applying the above example to the co-financing agreement, it appears that both the investor and the studio are working together on a project involving financing, production, and distribution of specified films. Neither party is a customer to the other party. Therefore, it appears that the arrangement is not subject to ASC 606.

The arrangement between the studio and the investor is more akin to a financing arrangement that may have certain characteristics of equity and debt investment. Generally, neither debt, nor equity financing arrangements are subject to ASC 606 (ASC 606-10-15, par c).

Conclusion: company’s investments in the film portfolio is not subject to ASC 606, Revenue from Contracts with Customers, as studio is not considered the investor’s customer.

Question 2: Are distribution proceeds received from exploitation of a film subject to ASC 808?

Investors raised a question of whether the arrangement will be subject to ASC 808, Collaborative Arrangements. ASC 808 does not provide substantial measurement and recognition criteria applicable to collaborative arrangements. Instead, it refers to other existing guidance and helps determine its applicability. ASC 808 defined a collaborate arrangement as follows (ASC 808-10-20, Glossary):

“a contractual arrangement that involved a join operating activity (see paragraph 808-10-15-7). These arrangements involve two (or more) parties that meet both of the following requirements:

-

- they are active participants in the activity (see paragraphs 808-10-15-8 through 15-9).

- they are exposed to significant risk and rewards dependent on the commercial success of the activity (see paragraphs 808-10-15-10 through 15-13).”

Active participation can take place in form of “participating in on a steering committee or other oversight or governance mechanism” (ASC 808-10-15-8). The accounting guidance is clear that “an entity that solely provides financial resources to an endeavor is generally not an active participant in the collaborative arrangement within the scope of this Topic.” (ASC 808-10-55-15-9). In most cases, investor’s role in the films is predominantly limited to providing financing. Although a standard co-financing contract specifies certain consultation provided by the investor relating to film production and distribution, in most situations we are aware of, no substantial consultations are performed. If the investor is not an active participant in the film development and distribution process, the arrangement is not considered a collaborative arrangement, as defined in U.S. GAAP. Studio’s management will have to assess individual fact pattern including investor participation to conclude if the arrangement in question is subject to ASC 808.

A collaborative arrangement could be partially within the scope of ASC 606. If a part of the arrangement is potentially a transaction with a customer, management should apply the guidance in ASC 606 to identify all distinct goods and services. We understand that in many cases, studios did not identify any components of the arrangements that would be subject to ASC 606. Specifically, some studios noted that consultations provided by investors to the Studio is likely not considered investor’s performance obligation, i.e., a promise to transfer to studio-customer any good or service (ASC 606-10-25-14) as the consultation with the investor appears to be studio’s obligation, not investor’s. Additionally, as noted above, the Studio is not considered to be investor’s customer.

Conclusion: In most cases, studio’s co-financing arrangement is not considered subject to ASC 808, Collaborative Arrangements, as the investor is not an active participant in the film development and distribution process.

Question 3: Are investments in a film portfolio subject to ASC 926, applicable to film industry?

Management raised a question of whether the Company’s investment should be subject to ASC 926-20, Entertainment-Films-Other Assets-Film Costs. According to the scope provisions of ASC 926-10-15-2:

“The guidance in this Topic applies to all entities that are producers or distributors that own or hold rights to distribute or exploit all kinds of films in one or more markets and territories. This Topic also applies to films exploited by the entity directly, or licensed or sold to others.”

ASC 926 defines a producer as “an entity that produces and has a financial interest in films for exhibition in movie theaters, on television, or elsewhere.” (ASC 926-20-20, Glossary). The Company holds a financial interest in films represented by its contractual right to distribution proceeds, and from this perspective, may satisfy definition of a producers. However, the Company does not own the films, nor does it hold any distribution rights as such rights are held by the Studio. The Company does not have any exploitation rights as deciding on a specific manner of exploitation is at Studio’s discretion. Instead, the Company holds cash flow rights with defined order of distribution. Therefore, the Company’s investment would not be subject to ASC 926.

Management considered if the Company can look through the Company’s legal form of the investment and consider its investment to be a direct investment in the film assets. U.S. GAAP does not offer explicit accounting guidance on this matter. In some cases, a “look-through” approach may be appropriate, while in others, it is not.

For example, as discussed in accounting guidance on investments in debt securities and equity securities, ASC 320-10-55-8 and ASC 321-10-55-6, an investor should not look through the form of its investment to the nature of the interests held by the investee to determine whether ASC 320 or ASC 321 applies, i.e., to determine the appropriate recognition and measurement model. This specifically relates to determining if the investment is considered debt or equity.

Overall, we believe that applying a “look-through” approach that would regard investments in a film portfolio as a direct film investment is not supported.

Conclusion: The investment is not considered subject to ASC 926-20, Entertainment-Films-Other Assets-Film Costs, as the investor does not directly own any films, nor does it hold any film distribution rights, as such rights are held by Studio. Management believes that applying a “look-through” approach that would regard the financial investment as a direct investment in the film portfolio is not supported by GAAP.

Question 4: Is company’s investment subject to ASC 946 Financial Services-Investment Companies?

Investment companies measure their investments initially at the transaction price and, subsequently, at fair value with changes in the fair value reported in the statement of operations (ASC 946-220-45-6b.1). Financial statements of investment companies include statement of assets and liabilities with a schedule of investments or a statement of net assets, which includes a schedule of investments therein (ASC 946-205-45).

Typically, an investment company sells its ownership interests and invests the proceeds to achieve its investment objectives and provides returns to its investors from the net income earned on its investments. ASC 946-10-15-4 defined investment companies as an entity regulated under the Investment Company Act of 1940. Most companies investing in film portfolios are not registered under the Investment Company Act of 1940. However, if the entity is not regulated by the above act, it can still meet the definition of the investment company.

According to ASC 946-10-15-6, an investment company does both of the following:

- obtains funds from investor(s) and provides the investor(s) with investment management services.

- commits to its investor(s) that its business purpose and only substantive activities are investing the funds for returns solely from capital appreciation, investment income, or both.

Additionally, another fundamental characteristic of the investment company is that (ASC 946-10-15-6):

“The entity or its affiliates do not obtain or have the objective of obtaining returns or benefits from an investee or its affiliates that are not normally attributable to ownership interests or that are other than capital appreciation or investment income.”

Company’s investment in the film portfolio is for the purpose of obtaining investment income. Company’s primary goal is to invest the funds provided by investors for returns.

According to ASC 946-10-15-7, an investment company also has the following typical characteristics:

- The company has multiple investments.

- The company has multiple investors.

- The company has investors that are not related to the parent or investment manager.

- The company’s ownership interests (i.e., ownership interest in the company) are in the form of equity or partnership interests.

- The company manages substantially all of its investments on a fair value basis.

Answers to above questions will largely depend on individual facts and circumstances of investor’s legal structure and operations. In some cases, an investor in film portfolio was formed primary with a purpose of entering into the co-financing agreement with the Studio and it does not have multiple investments. Company’s investors own the Company through their equity ownership. Generally, investors do not manage its investment on a fair value basis. Overall, characteristics d. and b. apply to the investor. Characteristics e. and c. likely do not apply. In such cases, applicability of characteristic a. may provide further clarify and help make proper determination.

To be an investment company, a company must have three fundamental characteristics noted in ASC 946-10-15-6 and stated above. According to ASC 946-10-15-8, an investment company also typically has characteristics a through e. However, the absence of one or more of those typical characteristics does not necessarily preclude an entity from being an investment company. If an entity does not possess one or more of the typical characteristics a. through e., it must apply judgment to determine, considering all facts and circumstances, whether its activities continue to be consistent with those of an investment company (ASC 946-10-15-8).

We believe that in most cases an investor will meet three fundamental characteristics of an investment company. However, it may not meet all other characteristics a through e. Therefore, reporting entities should carefully example relevant facts and circumstances and exercise their judgment in making a determination of whether the Company is subject to ASC 946.

We are aware of certain instances that the investor was determined to be an investment company subject to ASC 946. In many cases, companies investing in films that have multiple investments and multiple investors will be considered investment companies while those that do not meet either of the above conditions are not considered investment companies subject to ASC 946. The determination of whether the company is considered an investment company depends on individual facts and circumstances of investor’s legal structure and operations.

The rest of the analysis in this paper assumes that the Company is not considered an investment company subject to ASC 946.

Conclusion: Generally, companies investing in film portfolios are not registered under the Investment Company Act of 1940. However, if the entity is not regulated by the above act, it has certain fundamental characteristic and, potentially, meet other requirements. We are aware of certain instances that the investor was determined to be an investment company subject to ASC 946. In many cases, companies investing in films that have multiple investments and multiple investors will be considered investment companies while those that do not meet either of the above conditions are not considered investment companies subject to ASC 946. The determination of whether the company is considered an investment company depends on individual facts and circumstances of investor’s legal structure and operations.

Question 5: What other accounting guidance can apply to the Company’s investment in the film portfolio?

US GAAP defines a financial instrument as follows (ASC 825-10-20, Glossary):

Cash, evidence of an ownership interest in an entity, or a contract that both:

- Imposes on one entity a contractual obligation either:

- to deliver cash or another financial instrument to a second entity

- to exchange other financial instruments on potentially unfavorable terms with the second entity.

- Conveys to that second entity a contractual right either:

- To receive cash or another financial instrument from the first entity

- To exchange other financial instruments on potentially favorable terms with the first entity.

Investments in film portfolio give contractual right to cash to the investor and obligate the studio to pay cash. Therefore, the investments are considered financial instrument. More specifically, the investments are considered a financial asset, as defined in ASC 825-10-20, Glossary.

Financial assets may be subject to specific accounting guidance, depending on a type of the asset in question (e.g., equity or debt investment), as analyzed in further detail below. Our analysis is performed based on analyzing applicability of codified sections of GAAP applicable to financial assets including ASC 320, Investments – Debt Securities, ASC 321, Investments – Equity Securities, ASC 325-40, Beneficial Interest in Securitized Financial Assets and ASC 310, Receivables.

ASC 321, Investments – Equity Securities

The scope of ASC 321, Investments-Equity Securities includes (ASC 321-10-15-4):

“Investments in equity securities and other ownership interests in an entity, including investments in partnerships, unincorporated joint ventures, and limited liability companies as if those other ownership interests are equity securities.”

Although company’s investment does not meet the definition of a security per ASC 321-10-20, it does not necessarily exclude the investment from the scope of ASC 321. Non-security equity interest or ownership interest is within the scope of ASC 321 provided that the investor is not required to consolidate the issuer in accordance with the guidance in ASC 810 or account for the ownership interest using the equity method of accounting.

The investments in question are in film projects rather than a legal entity. From this perspective, it appears that the investment is in the unincorporated (i.e., unregistered as a separate legal entity) business, which does not preclude application of ASC 321. However, the investments are generally not made in a joint venture as defined in ASC 323-10-20, Glossary. We are also aware of some cases when the investments are made in a separate legal entity, e.g., an LLC, which does not prevent application of ASC 321.

Management raised a question of whether the Company’s investment may be considered an “equity interest” or “equity ownership interest.” U.S. GAAP does not offer a formal definition of equity interest, from the investor’s perspective. Management noted that cash-settled options on equity securities or options on equity-based indexes are not in the scope of ASC 321, because these instruments do not represent ownership interests in an entity (ASC 321-10-20, par. c). As the Company’s investment represents an interest in contractual cash flows contingent on future performance of specific film asset, it does not seem to represent an equity ownership interest. Overall, it appears that ASC 321-10 does not directly apply to the Company’s investment.

However, given the subjectivity of the above conclusion, the Company explored application of ASC 321 further below. Additional analysis involving application of ASC 321 is based on the assumption that the investment in question may be considered “equity-like.”

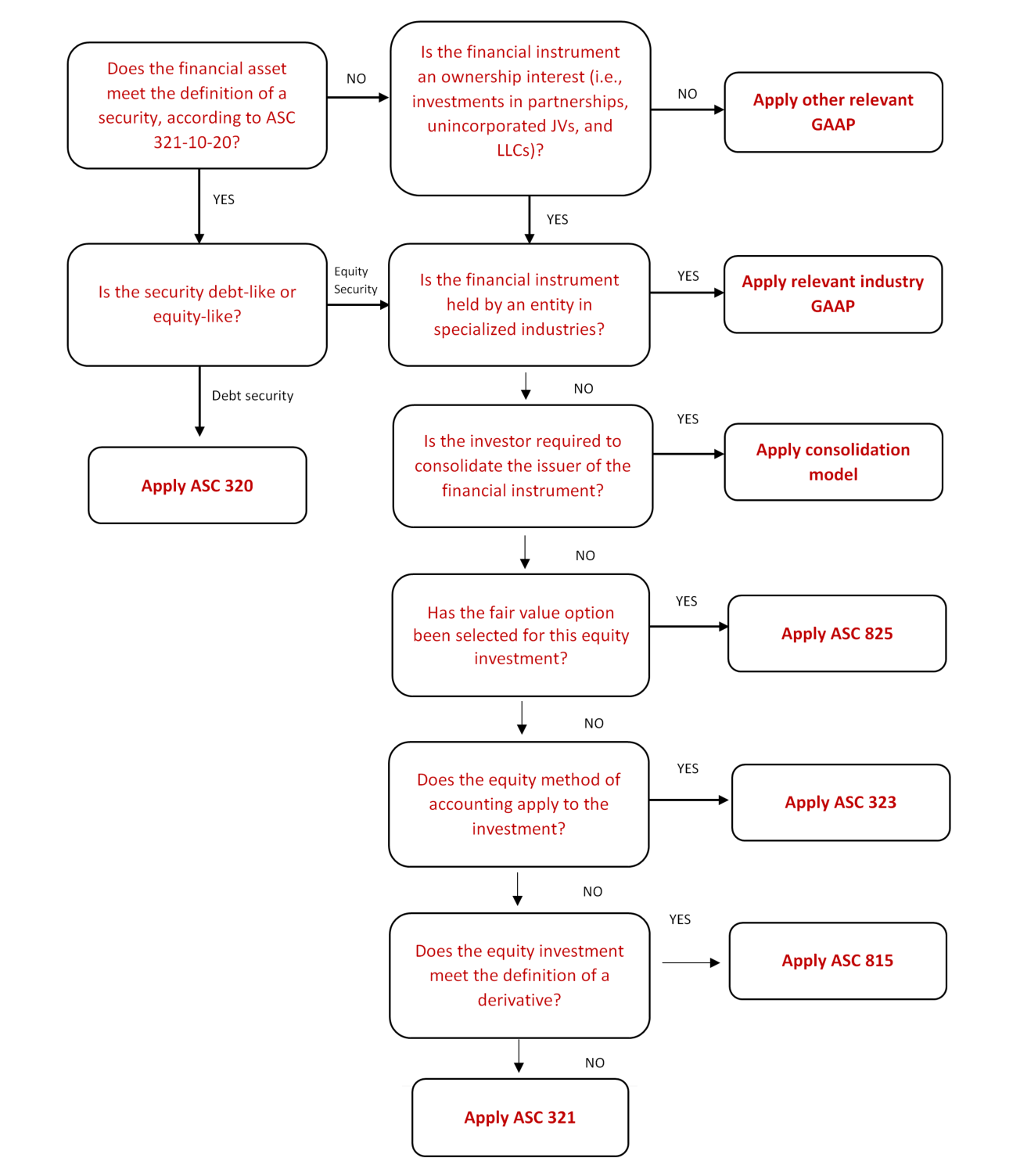

Appendix A Analysis of an equity interest held by for-profit reporting entities provides a framework for determining whether an investment in a financial instrument held by a for-profit reporting entity is within the scope of ASC 321.

Management analyzed application of the above framework step by step below.

- The financial instrument does not meet the definition of the security.

- For the purpose of this analysis, the assumption is that the investment is considered an equity ownership interest.

- Examples of specialized industries include:

– Brokers and dealers in securities

– Defined benefit pension plans and other postretirement plans

– Investment companies

As analyzed in Question 4 above, the Company is not considered an investment company as defined by U.S. GAAP. Overall, the Company does not operate in any specialized industry.

- Generally, the investor is not required to consolidate the investee. Detailed analysis of this matter is outside the scope of this publication.

- The investors decided not to apply the fair value option to the investment.

- The investment is not in the scope of equity method of accounting. Detailed analysis of this matter is outside the scope of this publication.

- Generally, the investment does not meet the definition of the derivative instrument as defined in ASC 815, Derivatives and Hedging.

Based on the above analysis and assuming that the investment can be categorized as equity ownership interest, the investment is subject to ASC 321.

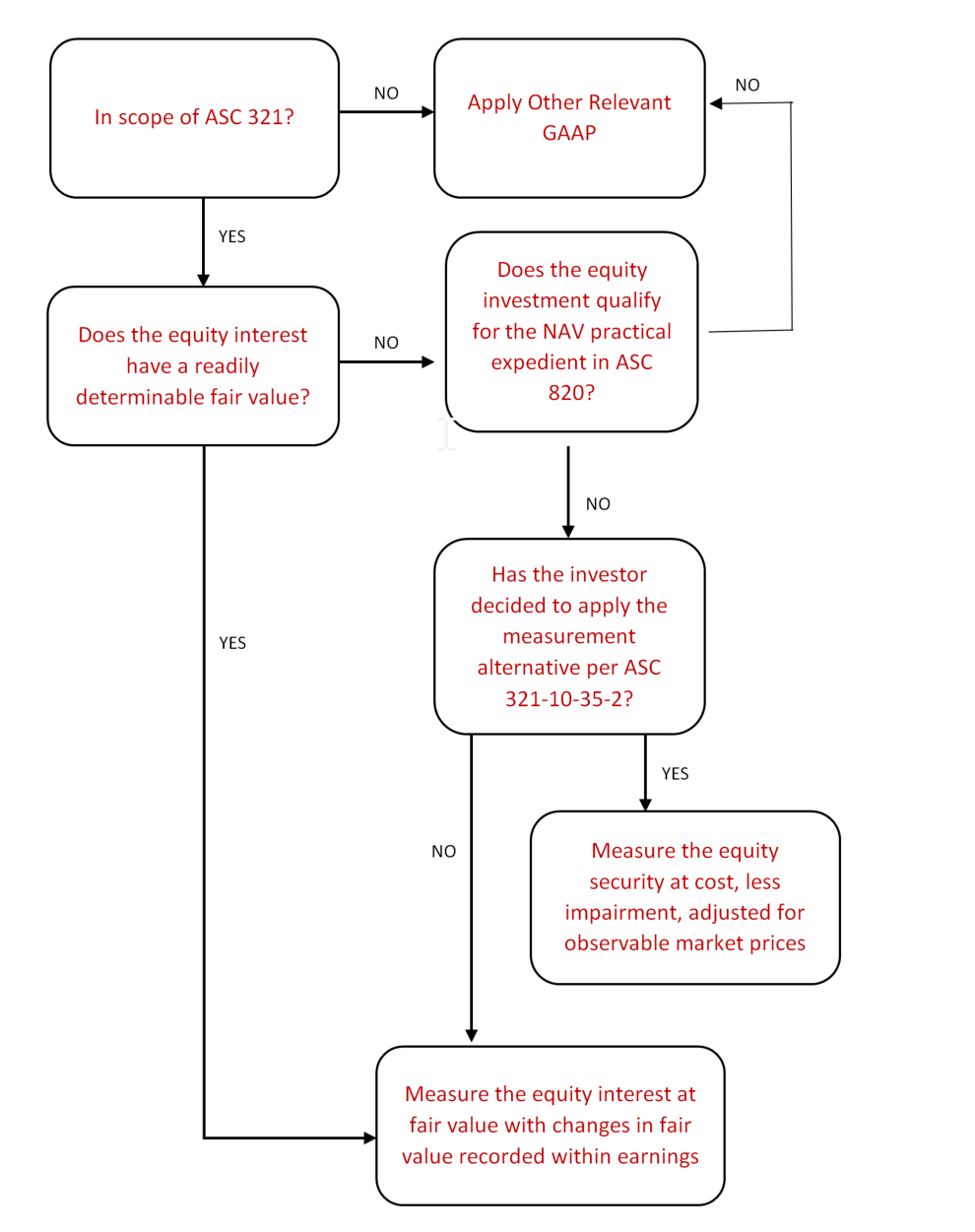

Appendix B ASC 321 Accounting for Equity Interest describes accounting models under ASC 321.

Management performed accounting analysis per Appendix B step by step below.

- ASC 321-10-20 provides a definition of a readily determinable fair value. Generally, the investments in question do not have a readily determinable fair value as defined in U.S. GAAP.

- Net Asset Value (NAV) exception applies to investments with net asset value determined consistent with measurement principles described in ASC 946, Investment Companies. As noted above, the Company does not use the measurement basis, i.e., fair value as required by ASC 946.

- When a reporting entity elects the measurement alternative in ASC 321, the equity interest is recorded at cost, less impairment. The carrying amount should be subsequently adjusted up or down for observable price changes (i.e., prices in orderly transactions for the identical investment or similar investment of the same issuer), if such prices changes are noted. Any adjustments to the carrying amount arising from observable price changes are to be recorded in net income. The above guidance covering cost measurement alternative is based on ASC 321-10-35-2.

If the measurement alternative is elected, the Company should perform an ongoing assessment to determine whether an equity interest has become impaired. The interest is impaired if, based on a qualitative assessment of impairment indicators, the fair value of the equity interest is less than its carrying amount. If so, an impairment charge equal to the difference between the carrying amount and fair value should be recorded in net income. The carrying amount of an equity interest should be adjusted for any observable positive or negative price changes even if it has previously been impaired. Impairment analysis for the above equity investments is not subject to ASC 329, i.e., CECL impairment model.

Dividend income or other similar distribution associated with the equity investments carried at cost are recorded by crediting income statement and debiting cash or dividend receivable account.

Additional Consideration: Election of the Fair Value Option

Financial assets for which the investor may apply the fair value option is described in ASC 825-10-15-4. ASC 825-10-15-5 described financial investments for which may not be subject to the fair value option. Based on our view of the above accounting guidance, the investor is likely to be able to apply the fair value option to its investment. If the investor decided to apply the fair value model, it would measure its investment in the film portfolio at fair value initially and subsequently.

ASC 825-10-15-4 allows election of the fair value option in relation to any recognized financial asset or liability, subject to certain limited exceptions. Therefore, selection of the fair value option does not depend on classification of the investment as equity or debt.

ASC 825-10 indicates that it does not establish requirements for recognizing and measuring dividend income, interest income, or interest expense, but that the reporting entity’s policy in these areas should be disclosed.

Based on existing accounting practices, reporting entities may apply one of the following models for reporting interest/dividend income related to financial assets accounted for at fair value with changes in fair value recorded in earnings:

- Present the entire change in fair value of the FVO item, including the component related to accrued interest/dividend, in a single line item in the income statement.

- Separate the interest/dividend income from the full change in fair value of the FVO item and present that amount in interest income. The remainder of the change in fair value should be presented in a separate line item in the income statement.

Conclusion: Film investment can be subject to ASC 321, provided the investment is considered an equity ownership interest. In this case, the investor may elect the measurement alternative and measure investments at cost less impairment. The investment is impaired if based on a qualitative assessment of impairment indicators, the fair value of the equity interest is less than its carrying amount. If so, an impairment charge equal to the difference between the carrying amount and fair value should be recorded in net income. The carrying amount of an equity interest should be adjusted for any observable positive or negative price changes, if such prices changes are identified. Distribution proceeds will be recorded by crediting income statement and debiting cash. The investor may also elect to measure the investments at fair value at each reporting date with the changes in fair value reported in the income statement. The selection of the fair value option does not depend on classification of the investment as equity or debt.

ASC 320, Investments – Debt Securities

ASC 320-10, Investments-Debt Securities applies to debt instruments represented by securities as defined in ASC 320-10-20. GAAP defined a security is follows:

Security: A share, participation, or other interest in property or in an entity of the issuer or an obligation of the issuer that has all of the following characteristics:

- It is either represented by an instrument issued in bearer or registered form or, if not represented by an instrument, is registered in books maintained to record transfers by or on behalf of the issuer.

- It is of a type commonly dealt in on securities exchanges or markets or, when represented by an instrument, is commonly recognized in any area in which it is issued or dealt in as a medium for investment.

- It either is one of a class or series or by its terms is divisible into a class or series of shares, participations, interests, or obligations.

Generally, investments in question are not divisible into a class or series of shares, participations, interests, or obligations. Therefore, the investments in question does not meet the definition of a security.

Conclusion: the investments not subject to ASC 320-10, Investments-Debt Securities as the investment is not considered a security.

ASC 325-40, Beneficial Interest in Securitized Financial Assets

A beneficial interest is defined in ASC 325-40-20, Glossary as follows:

“Rights to receive all or portions of specified cash inflows received by a trust or other entity, including, but not limited to, all of the following:

Senior and subordinated shares of interest, principal, or other cash inflows to be passed-through or paid-through

-

- Premiums due to guarantors

- Commercial paper obligations

- Residual interests, whether in the form of debt or equity”

ASC 325 applies to securities including certain securitized financial assets, debt or equity, e.g., loans, receivable, etc. As noted above, the investments are not considered a security, therefore, the investment is not subject to ASC 325.

Conclusion: the investments are not subject to ASC 325 applicable to securitized beneficial interests as the investment is not considered a security.

ASC 310, Receivables

The guidance in ASC 310, Receivables, applies to accounting for loans, trade receivable or non-trade (other receivables).

A loan is defined as follows (ASC 310-20-20, Glossary):

“A contractual right to receive money on demand or on fixed or determinable dates that is recognized as an asset in the creditor’s statement of financial position. Examples include but are not limited to accounts receivable (with terms exceeding one year) and notes receivable. This definition encompasses loans accounted for as debt securities.”

The investor does not have a right to demand repayment and the payments are not due on fixed or determinable date. The payments are due only if and when studio receives sufficient amount of distribution proceeds. Therefore, the investment in question is not considered a “loan”.

ASC 310 does not offer a definition of a receivable. We believe that two views on what constitutes a receivable balance may be appropriate. Under one view, a balance (other than a loan or a trade receivable) is considered a receivable if a company is entitled to a payment on a fixed or determinable dates, i.e., the payment is not contingent upon future events but is due upon passage of time. Under a different view, receivable balance subject to ASC 310 can encompass financial arrangements where payment is based on contingent events linked to performance of the underlying asset.

U.S. GAAP provides the following discussion supporting the view that the Company’s investment may be considered similar to a debt investment, i.e., accounts receivable rather than equity (ASC 860-20-35-2):

“Financial assets, except for instruments that are within the scope of Subtopic 815-10, that can contractually be prepaid or otherwise settled in such a way that the holder would not recover substantially all of its recorded investment shall be subsequently measured like investments in debt securities classified as available for sale or trading under Topic 320. Examples of such financial assets include, but are not limited to, interest-only strips, other beneficial interests, loans, or other receivables. Interest-only strips and similar interests that meet the definition of securities are included in the scope of that Topic. Therefore, all relevant provisions of that Topic (including the disclosure requirements) shall be applied. See related implementation guidance beginning in paragraph 860-20-55-33.”

We believe that the investment in question will likely not be subject to ASC 815, Derivatives and Hedging. The above guidance specifically relates to investments in securities and can only be applied to the investments in question by analogy. Overall, the above guidance supports classification of the investment as investment in debt, not equity.

Generally, receivables subject to ASC 310 are measured using amortizable cost basis. Receivable balances are subject to impairment analysis. Before adoption of CECL impairment model, the impairment is recognized when it is probable that a loss in value has occurred and the amount of can be reasonably estimated, according to ASC 450-20, Loss Contingencies (ASC 310-10-35-2 and 8). Receivables will be subject to CECL impairment model applicable upon adoption of ASC 326 or ASU 2016-13. Cash proceeds received from the payer are recorded as a settlement of the receivable balance, i.e., by debiting cash and crediting carrying amount of receivable. In general, the above model is similar to accounting for loans in terms of a) using amortized cost as a subsequent measurement basis and b) recording cash proceeds as a reduction of carrying amount of the balance.

Management noted that the above accounting treatment is based on the interpretation that the investments are similar to a debt instrument rather than an equity instrument.

Conclusion: The Company’s investment can be subject to ASC 310 provided that the investment is viewed as debt-like or a receivable balance. In this case, the investment is measured on an amortizable cost basis. Receivable balances are subject to impairment analysis. At the time of writing of this publication, the impairment is recognized when it is probable that a loss in value has occurred and the amount of can be reasonably estimated, according to ASC 450-20, Loss Contingencies (ASC 310-10-35-2 and 8). Receivables will be subject to current expected credit loss (CECL) impairment model applies upon adoption of ASC 326 or ASU 2016-13. Cash proceeds received from the payer are recorded as a settlement of the receivable balance, i.e., by debiting cash and crediting carrying amount of receivable.

Question 6: Should the Company’s investment be considered equity-like or receivable-like?

Management noted that application of either ASC 321 or ASC 310, i.e., equity or debt related guidance, respectively, depends on the nature of the investments in question. If the investment is considered equity-like, ASC 321 appears to be more appropriate, while ASC 310 would be more applicable to debt-like investments. Generally, equity investments represent a residual interest in an entity. Terms or features that are not consistent with a residual interest in the issuing entity would most likely be considered equity-like. Otherwise, the relations between the investor and the studio may be more akin to a debtor-creditor relationship than to an ownership relationship. Most commons debt investments, e.g., loans carry creditor rights including investor’s ability to seek recourse in a bankruptcy court.

Management noted that U.S. GAAP provides substantial amount of guidance relevant to equity vs. liability classification from issuer or investees perspective. Limited guidance is provided from investor’s perspective. However, existing guidance relevant to investee’s may be applied by analogy.

We believe guidance provided in ASC 480, Distinguishing Liabilities from Equity and ASC 815-15, Embedded Derivatives is likely to be particularly relevant to making the determination if the investments in question should be considered debt-like or equity-like.

Debt vs. equity classification guidance provided in ASC 815 applies to hybrid financial instruments with an embedded derivatives to determine if the host instrument is considered debt or equity. From this perspective, it can only be applied to the investments in question by analogy. Appendix C Debt and Equity-Like Characteristics illustrates which characteristics of a financial instrument are generally more equity-like or debt-like based on the guidance provided in ASC 815-15-25-17D. We analyzed characteristics referred in Appendix C one by one below.

The instruments are entitled to a share proceeds similar to discretionary, participating dividends based on earnings as compared to fix mandatory dividends. Therefore, analysis of dividend or equivalent rights points towards equity-like classification.

Generally, the investments in question do not give the investor any formal voting right. However, the investee has an obligation to consult with the investor on material production and distribution matters. Overall, we believe that the analysis of voting rights points towards equity-like classification.

The investments do not carry any redemption rights, i.e., an option to sell the investments at a fixed or determinable price. Instead, the instrument in question appears to be perpetual in nature as there is no set time horizon as to when a specific movie will case to generate cash proceeds. Overall, we believe that the analysis of voting rights points towards equity-like classification.

The investor does not have any conversion rights that would allow or require a conversion into a fixed amount of assets or stock. From this perspective, lack of conversion rights points to debt-like classification.

The investor has certain protective rights stated in terms of the co-financing agreement. Those rights include the following:

- The right to invest in specific films, restricting investee ability to make its own decisions regarding the use of funds;

- Consultation rights on material production and distribution matters;

- Audit rights as they apply to film proceeds reported by the investee;

According to par. e ASC 815-15-25-17D, “not all protective covenants are of equal importance”. Covenants that provide substantive protective rights may be given more weight than covenants that provide only limited protective rights. In our view, the analysis of protective rights does not definitively point towards debt or equity-like classification of the instrument in question.

GAAP acknowledgers that an individual term or a feature may weigh more heavily in debt vs. equity evaluation on the basis of the facts and circumstances. However, an entity should use judgment based on an evaluation of all of the relevant terms and features. (ASC 815-15-25-17A).

Overall, the analysis of dividend, voting, redemption, conversion and protective rights point towards classification of the investments as equity-like, not liability-like.

ASC 480 provides additional guidance on debt or equity classification of freestanding (not embedded) investments by the investee. According to ASC 480-10-25-8:

“An entity shall classify as a liability (or an asset in some circumstances) any financial instrument, other than an outstanding share, that, at inception, has both of the following characteristics:

-

- It embodies an obligation to repurchase the issuer’s equity shares, or is indexed to such an obligation.

- It requires or may require the issuer to settle the obligation by transferring assets.

In this Subtopic, indexed to is used interchangeably with based on variations in the fair value of. The phrase requires or may require encompasses instruments that either conditionally or unconditionally obligate the issuer to transfer assets. If the obligation is conditional, the number of conditions leading up to the transfer of assets is irrelevant.”

ASC 480 guidance is clear that instruments that may require an issue to settled in cash or other assets are considered liabilities. From this perspective, investments that are settled in cash upon occurrence of contingent events are considered liabilities.

Since film investment may be settled in cash depending on the level of cash proceeds, applying the above guidance by analogy, will result in classification of the investments in film as a receivable or debt investment.

As noted above, ASC 480 applies to freestanding financial instruments, while guidance in ASC 815-25 is relevant to classification of the host in a hybrid instrument including one (or more) embedded derivatives. Generally, debt and equity characteristics provided in ASC 815-15-25-17D are used to determine if the economic characteristics and risks of the embedded feature are clearly and closely related to those of the host. According to 815-15-25-54, “If an embedded derivative is separated from its host contract, the host contract shall be accounted for based on GAAP applicable to instruments of that type that do not contain embedded derivatives.” The above requirement implies that debt or equity classification of the host would be subject to the accounting guidance outside of ASC 815-15, including ASC 480.

Investments in film portfolio are likely not to be considered a hybrid financial instrument, i.e., the instruments consisting of a “host contract” into which one or more derivative terms have been embedded. Therefore, ASC 480 guidance applicable to freestanding, not embedded instruments would be more relevant to the investments in question than ASC 815-15 guidance. Additionally, equity and debt-like characteristics described in 815-15-25-17D do not appear to establish classification guidance for the host.

Based on the above considerations, we believe that the investments can be viewed as a receivable or investment in debt, not in equity, based on ASC 480 guidance applied by analogy.

Given the lack of authoritative guidance on the matter, the above determination that the investment is similar to investments in debt and not in equity is subjective and involves substantial amount of judgment. A user of the investor’s financial statements may support an alternative view.

Conclusion: By applying equity vs. liability classification guidance provided in ASC 480 by analogy, the investments can be appropriately considered as receivable-like or the investment in debt rather than the investment in equity. Therefore, the investment should be accounted for using guidance per ASC 310, Receivables.

Question 7: How should financing proceeds provided by the investor be reflected in investees financial statements?

As part of the agreement, the investor deposits financing proceeds in the escrow account. Investee or a studio uses the proceeds to finance film production for agreed-on films. According to some financing agreements, withdrawal of fund from the escrow account is made based on the mutually agreed financing schedule.

Some studios raised a question of how they should report financing proceeds provided by the investors. Specifically, the question here is whether funds provided by the investors are considered investee’s assets and should be reported on its balance sheet.

Statement of Financial Accounting Concepts (CON) No. 6 Elements of Financial Statements defines assets as probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.” (par. 25 of CON 6). “the entity has the ability to obtain and control the benefit in other ways” (par. 25-29 of CON 6).

Three essential characteristics of an asset are: (a) it embodies a probable future benefit that involves a capacity, singly or in combination with other assets, to contribute directly or indirectly to future net cash inflows, (b) a particular entity can obtain the benefit and control others’ access to it, and (c) the transaction or other event giving rise to the entity’s right to or control of the benefit has already occurred. (par. 26 of CON 6.) According to CON 6’s par. 26:

“…although the ability of an entity to obtain benefit from an asset and to control others’ access to it generally rests on a foundation of legal rights, legal enforceability of a claim to the benefit is not a prerequisite for a benefit to qualify as an asset if the entity has the ability to obtain and control the benefit in other ways.”

The Studio will use financing proceeds to make film investments which it expects to derive benefits from. The Studio can limit other party’s access to the funds through the legal arrangement of the escrow account. Investor’s transfer of funds to the Studio under the terms of financing agreement is likely to be considered an event giving rise to studio’s right to benefit from the asset in question. Based on the above analysis, the financing proceeds are considered studio’s assets and should be recorded on its balance sheet.

Keeping financing proceeds in the escrow account establishes custodial relations whereby the proceeds are kept in the custody intended to safeguard the assets. Although GAAP does not provide explicit guidance on how a custodian should account the assets in custody, a number of accounting practices have been emerged. Some of these practices are described below and can be applied to studio’s accounting by analogy. Brokerage firms regulated by the SEC, pool client assets and report them on their balance sheet by debiting asset referred to as assets under custody and crediting liabilities, reflecting an obligation to return the assets to clients. The assets are kept in “street name”, i.e., in the name of the brokerage firm and not investor’s name. From this perspective, the brokerage, assuming the role of a custodian, acts as an “owner of record” or “nominee owner”, different from the “beneficial owner”. When assets are held in “street name”, they are often used for a variety of brokerage activities and are subject to legal claims by creditors in the event of the brokerage firm’s insolvency.

National banks e.g., JP Morgan Chase & Co, U.S. Bank represent a different type of custodian. Investments held by the bank in custody for customers are kept separate from the bank’s assets, are not reported on the bank’s balance sheet. The assets in question are not subject to the creditor claims. As such, even upon a bank’s insolvency, customer assets should be returned to each individual investor. Note that bank cash deposits are not investments or securities, even if they are held in a custody account. Deposits at a bank are not kept separate and apart from the bank’s assets, are reflected on the bank’s balance sheet, and are subject to creditor claims.

Financial institutions such as a bank or a brokerage firm are generally not entitled to investment gains and do not bear risk of loss associated with the investments in custody. Instead, the financial institutions are entitled to advisory and investment management fees calculated as a percentage of assets under management (e.g., 1.02% a year).

Based on the above accounting practices, certain terms and conditions impacting studio’s rights and obligations associated with the funds kept in the trust account may override the conclusion that the investment proceeds are considered studio’s assets. In fact, we believe that if the assets in question are not subject to claims of studio creditors, they are not reported as part of studio’s assets and liabilities.

Investees should carefully analyze the terms associated with financing proceeds provided by the investors. A legal advice may be sought to determine if the proceeds kept in the escrow account are subject to investee’s creditor claims.

Conclusion: Generally, we believe that the financing proceeds provided by the investor are considered studios assets and should be recorded on its balance sheet. However, certain terms and conditions impacting studio’s rights and obligations associated with the funds kept in the escrow account may override the conclusion that the investment proceeds are considered studio’s assets. The conclusion may change if the assets are in question are not subject to claims of studio creditors. Studios should carefully analyze the terms associated with financing proceeds and consult their advisors to establish proper accounting treatment.

Appendix A

Analysis of investments held by for-profit reporting entities

Appendix B

ASC 321 Accounting for Equity Interest

Appendix C*

Debt and Equity-Like Characteristics

| Feature | Equity | <- – – – – | – – – – -> | Debt-like |

| Redemption | Perpetual | Puttable at holder’s option upon contingent event | Puttable at holder’s option with the passage of time | Mandatorily redeemable |

| Dividends | Cumulative and, potentially, noncumulative participating |

Noncumulative fixed rate and, potentially, indexed variable rate

|

Cumulative fixed rate and, potentially, cumulative indexed variable rate | |

| Voting Rights | Votes with common on as-converted basis | Votes with common on as-converted basis on specific matters | Votes only on matters related to the specific instrument |

Nonvoting |

| Covenants | Does not include provisions that are substantively protective covenants | Includes provisions that are substantively protective covenants | ||

| Conversion Rights | Mandatorily convertible | Optionally convertible | Not convertible | |

*Based on the diagram provided in section 3.2.6.1.1 Weighing terms and features of EY Issuer’s accounting for debt and equity financings.

Important Note: FinAcco Consulting LLC is not responsible for, and no person should rely upon, any advice or information presented on this website. Note that entity’s financial statements, including, without limit, the use of generally accepted accounting principles (“GAAP”) to record the effects of any proposed transaction, are the responsibility of management. Therefore, any written comments by FinAcco Consulting LLC about the accounting treatment of selected balances or transactions or the use of GAAP are to serve only as general guidance. Our comments are based on our preliminary understanding of the relevant facts and circumstances and on current authoritative literature. Therefore, our comments are subject to change. FinAcco Consulting LLC does not assume any responsibility for timely updates of its website overall or any information provided in the Insights section of the website, specifically.