SPAC Financial Close

SPAC Financial Close

SPAC Background

A SPAC or a special purpose acquisition company is a shell company listed on a stock exchange with the purpose of acquiring a private company and, therefore, making it public without going through the traditional IPO process. SPAC is registered with the SEC and is a publicly traded company.

SPACs have limited activities. Entity’s transactions include receiving legal and accounting services, interest income, accruing and payment of franchise and income taxes, etc. SPACs also account for cash, prepaid assets, IPO proceeds kept at a trust account, prepaid assets, accounts payable, deferred underwriting commission, temporary and permanent equity, among other items.

Financial Close

SPAC financial close includes recording relevant entries in entity’s accounting system as well as preparation of, based on recorded entries, full set U.S. GAAP financial statements. The financial statements include primary forms, i.e. balance sheet, income statement, cash flow statement and statement of change in equity and footnotes to the financial statements.

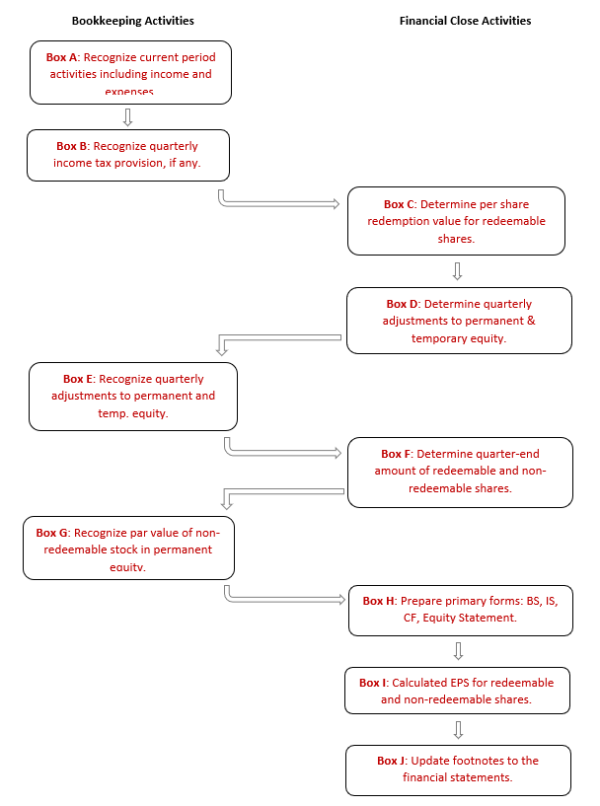

Diagram A: SPAC Accounting Close provides an overview of key activities performed as part of SPAC financial close. Accounting activities are broken down between current period bookkeeping, i.e. recording of journal entries and financial close activities.

Box A- Recognize current period activities including income and expenses

SPAC accounting team should recognize current period income and expense items as well other relevant transactions. Generally, SPAC current period income (expense) includes the following:

- legal, audit, tax, other professional fees and expenses;

- interest income associated with IPO proceeds kept at a trust account;

- interest expenses associated with a promissory note issued to a related party, if any;

- warrant revaluation adjustments for warrants classified as liability instruments;

SPAC current period activities also include cash receipts and payments as well as other activities impacting entity’s balance sheet (e.g. amortization of prepaid assets).

Box B- Recognize quarterly income tax provision, if any

SPAC quarterly financial statements should reflect income tax provision including current and deferred income taxes, if applicable, recognized according to with ASC 740, Income Taxes. Some SPACs are also subject to state franchise tax, i.e. a state tax generally based on such non-income measures as total capital or net worth of the reporting entity.

Box C- Determine per share redemption value for redeemable shares

SPAC shares issued to public shareholders are subject to potential redemption by the SPAC. The redemption is at shareholder’s option that may be exercised in connection with completion of the merger transaction, subject to other limitations described below. SPACs repot common stock subject to potential redemption as temporary equity, consistent with requirements of ASC 480-10-S99-3A.

As part of monthly, close the financial reporting team should determine the redemption value of public shares. Generally, the redemption value per public share is determined using the following formula:

Per Share Redemption Value = ( IPO Proceeds Held in Trust – Current Income Tax Liability (net) ) / Public Shares Issued and Outstanding

IPO proceeds above include earned interest. Current income tax liability relates to interest income subject to taxation. No deduction of current income tax is required, if the amount of interest associated with trust funds is already net of taxes.

For more details regarding presentation and measurement of temporary equity refer to FinAcco’s publication SPAC Accounting Issues.

Box D- Determine quarterly adjustments to permanent & temporary equity (before the impact of recent SEC Comment Letters concerning reporting of temporary equity)

As noted above, SPACs report common stock subject to potential redemption as part of SPAC temporary equity. However, according to SPAC certificate of incorporation, the entity will not redeem its public shares in an amount that would cause SPAC net tangible assets (NTA) to be less than $5,000,001. The above limitation was introduced to ensure that SPAC NTA will be at least $ 5,000,000 so that it is not subject to SEC rules applicable to “penny stock”. NTAs are defined as total assets less liabilities and intangible assets. For most SPACs, the amount of net tangible assets is not materially different from SPAC’s permanent equity.

Based on the above redemption requirements, many SPACs measure their period-end permanent equity not to be lower than $ 5,000,001, e.g. $ 5,000,001 or $ 5,000,002. Remaining IPO proceeds is to be reported as part of temporary equity. SPAC financial reporting team determine journal entries, impacting quarter-end temporary and permanent equity, consistent with the above presentation of redeemable and non-redeemable public shares.

Box E- Recognize quarterly adjustments to permanent and temporary equity (before the impact of recent SEC Comment Letters concerning reporting of temporary equity)

Accounting team recognizes quarter-end adjusting entries to appropriately reflect temporary and permanent equity. Entries impacting permanent equity are recorded in entity’s additional paid-in capital. Following recognition of the above entries, quarter-end monetary value of SPAC permanent equity should be approximately $ 5,000,001.

Box F- Determine quarter-end amount of redeemable and non-redeemable shares (before the impact of recent SEC Comment Letters concerning reporting of temporary equity)

After financial reporting team determined redemption value per public share (Box C) and monetary value of temporary equity (Box D), it calculates the amount of quarter-end shares subject to potential redemption. The amount of potentially redeemable shares is determined as follows:

Redeemable Shares = Temporary Equity / Per Share Redemption Value

Then, the amount shares not subject to potential redemption is calculated as the difference between all authorized and issued public shares and shares subject to potential redemption per above.

Amount of shares subject to potential redemption is reflected on the face of entity’s balance sheet using the following language:

“Common stock subject to possible redemption, [A] and [B] shares at redemption value at December 31, 20X0 and December 31, 20X1, respectively”.

Amount of shares not subject to potential redemption is also presented on the face of the balance sheet using the following language:

“Class A Common stock, $0.0001 par value; [C] shares authorized; [D] and [E] issued and outstanding (excluding [A] and [B] shares subject to possible redemption at December 31, 20X0 and December 31, 20X1, respectively)”.

Box G- Recognize par value of non-redeemable stock in permanent equity (before the impact of recent SEC Comment Letters concerning reporting of temporary equity)

SPACs report non-redeemable common shares in its equity statement at par value while the excess of par value over issuance proceeds in recognized as part of additional paid-in capital (APIC). Par value of most SPAC common shares is $ 0.0001/share. Once the financial reporting team determined the amount of non-redeemable shares (Box F), the accounting team should reflect the par value of the shares in entity’s statement of changes in equity. Respective period-end journal entries impact commons stock at par value as well as entity’s APIC. The above entries do not result in net change in SPAC permanent equity.

Impact of recent SEC Comment Letters concerning reporting of temporary equity:

Historically, SPACs measured their period-end permanent equity not to be lower than $ 5,000,001, e.g. $ 5,000,001 or $ 5,000,002. Remaining IPO proceeds were to be reported as part of temporary equity. Following the above accounting practice has resulted in classification of some but not all public shares as contingently redeemable, i.e. part of temporary equity. Historical accounting practice was justified by the legal terms according to which a SPAC will not redeem its public shares in an amount that would cause SPAC net tangible assets (NTA) to be less than $5,000,001.

Starting in late July 2021, SEC has issued a number of comment letters questioning SPAC’s historical accounting for public shares subject to redemption. SEC’s specific focus was that SPACs classified some but not all public shares as subject to redemption. Following SEC comment letters, many SPACs presented all public shares as part of their temporary equity. As part of the revised presentation, total value of temporary equity was calculated as follows:

Temporary Equity = Per Share Redemption Value * All Redeemable Shares

As part of the revised approach, the amount of temporary equity is determined without the regard to the $ 5,000,001 threshold for permanent equity (see Box D above).

Consistent with the historical approach as reflected in Box E above, the amount of temporary equity is recognized to reduce the reportable value of permanent equity. However, given that revised presentation resulted in reporting more shares as subject to redemption and corresponding increase in temporary equity, the revised presentation has also resulted in reduction of SPAC’s permanent equity.

Since the amount of redeemable and non-redeemable shares under the “new” approach have changed, i.e. all public shares are classified as redeemable, the change directly impacts the disclosures provided in Box F above.

The revised approach also impacts procedures described in Box G. No adjustments to entity’s par value of IPO shares and APIC would be required as all public shares are reported as part of temporary equity upon their initial recognition.

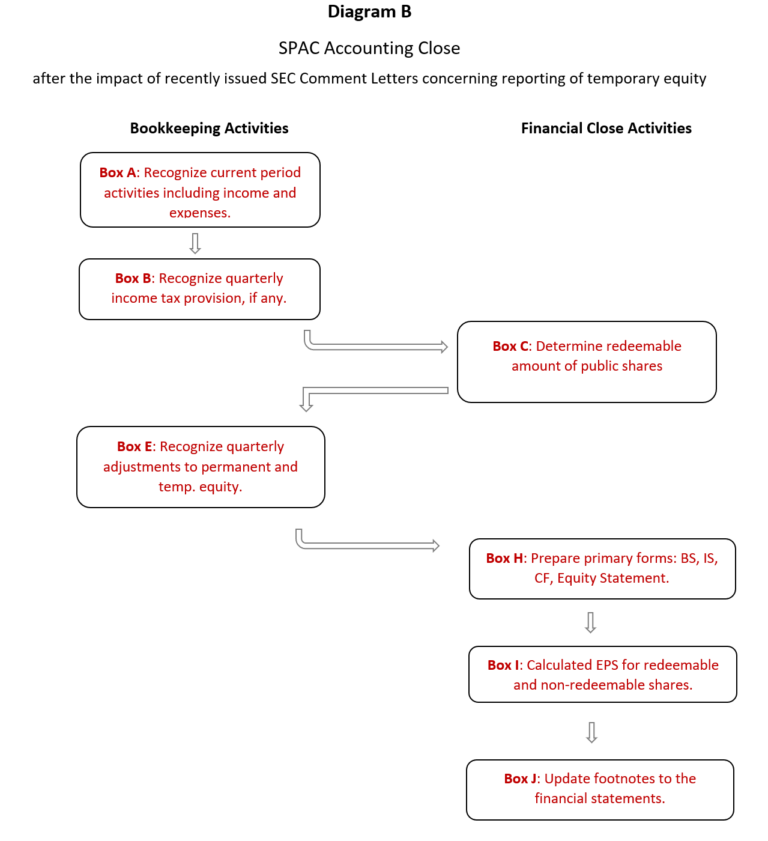

Diagram B: SPAC Accounting Close provides an overview of key closing activities under the revised approach for presentation of IPO shares.

The above changes impact SPAC’s financial statements as well as information presented in capitalization table disclosing SPAC’s temporary and permanent equity and debt capital at a historical pre-IPO date and immediately after the IPO.

We understand that some but all SPACs have adopted the revised presentation of public shares subject to redemption. SPACs following the revised rules have to give additional considerations to compliance with $ 5 m NTA requirement. Given the reduction in the amount of permanent equity, some SPACs had to attract additional financing, e.g. by issuing common stock or other equity instruments that would not be subject to redemption requirements.

Box H- Prepare primary forms: BS, IS, CF, Equity Statement

After all relevant journal entries are recognized in SPAC’s general ledger, the financial reporting team prepares primary forms. Generally, SPACs primary forms are the balance sheet, income statement (or statement of operations), statement of changes in equity and cash flow statement. Many existing software products automate the process of preparing primary forms, however, depending on a software product, some financial reporting teams find it more convenient to prepare the statement of changes in equity and cash flow statement in Excel using other primary forms as an input.

Box I- Calculated EPS for redeemable and non-redeemable shares

Once the financial reporting term determined the amount of quarter-end shares subject to potential redemption and non-redeemable shares, the share information is used to calculate earnings per share (EPS). Generally, SPACs follow two-class EPS method consistent with the requirements of ASC 260-10-55-23 through 55-31. SPACs should determine weighted average shares outstanding for both classes of shares. For more details regarding application of the two-class EPS method refer to FinAcco’s publication SPAC Accounting Issues.

Box J- Update footnotes to the financial statements

Financial reporting team will need to prepare footnotes to the financial statements. Footnotes should disclosure applicable information as required by U.S. GAAP. Generally, SPAC footnotes include description of SPAC operations including terms of the initial IPO, SPAC accounting policies, warrant terms, classes of common and preferred stock including related rights and privileges, fair value measurements, income taxes and subsequent events. Fair value disclosures cover such balance sheet items as cash and cash equivalents held in the trust account and, if applicable, liability-classified warrants. Income tax disclosures include income tax reconciliation per ASC 740-10-50-12.

As part of the close, accounting or financial reporting team should prepare bank reconciliation. The team should also prepare reconciliations of other balance sheet accounts to ensure that period-end balances are accurate. Management should establish other financial reporting controls to ensure all transactions are authorized by the appropriate personnel.

Diagram A: SPAC Accounting Close

(before the impact of recent SEC Comment Letters concerning reporting of temporary equity)

Diagram B: SPAC Accounting Close

(after the impact of recent SEC Comment Letters concerning reporting of temporary equity)

Important Note: FinAcco Consulting LLC is not responsible for, and no person should rely upon, any advice or information presented on this website. Note that entity’s financial statements, including, without limit, the use of generally accepted accounting principles (“GAAP”) to record the effects of any proposed transaction, are the responsibility of management. Therefore, any written comments by FinAcco Consulting LLC about the accounting treatment of selected balances or transactions or the use of GAAP are to serve only as general guidance. Our comments are based on our preliminary understanding of the relevant facts and circumstances and on current authoritative literature. Therefore, our comments are subject to change. FinAcco Consulting LLC does not assume any responsibility for timely updates of its website overall or any information provided in the Insights section of the website, specifically.