SPAC Equity Forward Agreements

SPAC Background

A SPAC or a special purpose acquisition company is a shell company listed on a stock exchange with the purpose of acquiring a private company and, therefore, making it public without going through the traditional IPO process. SPAC is registered with the SEC and is a publicly traded company. Therefore, general public can buy SPAC’s shares before the merger or acquisition takes place.

SPAC process differs from tradition IPO in a way that the target that eventually becomes the public company is not involved in SPAC’s formation and IPO. SPAC will also use proceeds received from public investors to finance potential acquisition transaction. SPAC’s time to identify a suitable target is limited to 24 months. The identity of the target as well as whether the acquisition will take place is uncertain, at the time of SPAC’s IPO.

FPA Background

Some SPACs signed a forward purchase agreement (FPA), an arrangement that obligates SPAC to issue to its sponsor a specified amount of SPAC units in exchange for cash at the time of closing of merger transaction. The agreement become effective concurrently with the IPO. SPAC units issuable under the terms of FPA include common stock and warrants. Cash consideration is defined as a fixed amount per unit (e.g. $ 10 per a unit). The amount of units can be increased, at the option of the sponsor, by a specified amount, in which case overall cash consideration will increase accordingly.

As an example, concurrently with the closing of business combination SPAC shall issue and sell to the sponsor 1,000,000 units at a price of $ 10 per unit and total consideration of $ 10,000,000. At the option of the sponsor, the amount of units can increase to up to 2,000,000 at a price of $ 10 per unit and total consideration of $ 20,000,000. Each unit consists of 1 Class A common share and half of a warrant.

Generally, warrants sold as part of FPA are the same warrants that were issued to public investors as part of SPAC’s IPO, i.e. so-called public warrants.

The purpose of FPAs is to commit to the combined entity capital required to finance its operations while enabling sponsors to potentially benefit from the additional equity interest. Per unit contract price is usually set at market so that the intrinsic value of the contract is zero at inception. Contract value at settlement depends on the relationship between the initial FPA price and the price of underlying shares at that time. The contract results in a gain to one party and a loss to the other party as the underlying share price fluctuates.

The contract is settled in shares and warrants only. Generally, FSA settlement price (e.g. $ 10) is fixed throughout the life of the contract.

Based on the information we have, approximately 20% of all SPACs signed a forward purchase agreement (statista.com).

Questions arose of how to account for SPAC forward purchase agreements under U.S. GAAP.

Accounting Analysis- General

A forward purchase agreement signed by a SPAC is considered a type of equity forward or a contract between two parties under which one party must deliver, at a future date (settlement date), an equity security in exchange for an agreed-on price that the other party must pay. The equity forward in question is contingent on the occurrence of an event that is not certain to occur. Unlike an option, both parties to an FSA are required to perform in accordance with the agreed-on terms.

Price per unit is referred to as forward or contract price. The number of underlying equity securities to be delivered is called the notional amount.

U.S. GAAP refers to the above FPA arrangements as forward sale agreements (FSA) as from the issuer perspective, the units will be sold to the sponsor. FSAs are further defined in ASC 815-40-55-13.

Forward Sale Agreement: Classification and Measurement

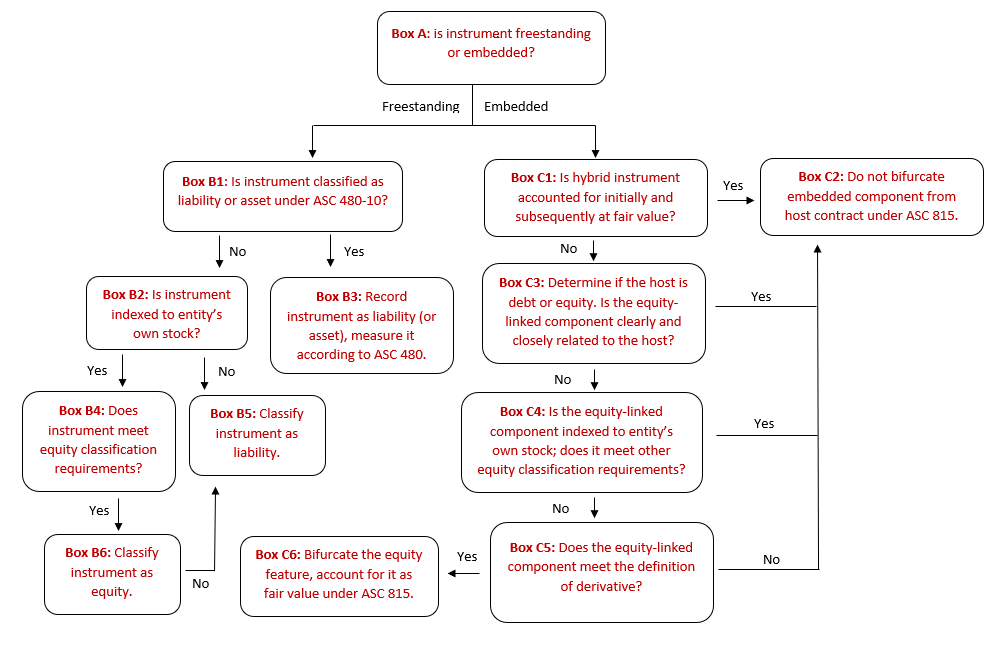

FSAs signed by SPACs are considered equity-linked financial instruments as the contract involves future issuance of equity units including common stock and warrants. Appendix A Accounting for Equity-Linked Financial Instruments illustrates a general approach to accounting to equity-linked instruments.

Box A: The first step in the analysis is to determine if the instrument is considered an embedded or free-standing.

According to ASC 815-10, Glossary, an instrument is considered freestanding if either of the following two conditions apply:

- the instrument is entered into separately and apart from any of the entity’s other financial instruments;

- it is entered into in conjunction with some other transaction and is legally detachable and separately exercisable;

FSA becomes effective concurrently with the IPO and, as such, is linked to the underlying IPO transactions. Therefore, some believe that FSA was not entered separately from other financial instruments. Generally, FSA terms do not allow transfer of the underlying rights and responsibilities. Therefore, if the instrument is considered to be entered in conjunction with another transaction, it is likely considered embedded and not freestanding.

Opponents of this view believe that an FSA constitutes a legally separate agreement and, therefore, a freestanding instrument. According to an extract from ASC 815-15-25-2:

The notion of an embedded derivative in a hybrid instrument refers to provisions incorporate into a single contract, and not to provisions in separate contracts between different counterparties.

Overall, we believe that classifying FSA as a freestanding contract is likely to be appropriate.

Box B1: Next step in the analysis is to determine if the instrument is included in scope of ASC 480, Distinguishing Liabilities from Equity. ASC 480 applies to freestanding equity-linked instruments considered mandatorily redeemable or meeting other specific requirements. Generally, instruments included in the scope of ASC 480 are considered liability (or asset) instruments.

Mandatorily redeemable shares are defined as instruments that embody an unconditional obligation requiring the issuer to redeem the instrument by transferring its assets at a specified event or upon an event that is certain to occur (ASC 480-10-20, Glossary). When the obligation is conditional, e.g., it depends on an uncertain event, the instrument becomes mandatorily redeemable if the event occurs or becomes certain to occur (ASC 480-10-25-5).

An issuer is not required to redeem FSA as a freestanding instrument. Therefore, at FSA-level, i.e. ignoring redemption terms applicable to underlying commons stock and warrants, the instrument is not redeemable. However, according to the established accounting practice, forward sale contracts issued on redeemable (puttable) stock are considered redeemable instrument subject to ASC 480.

Public shareholders may, at their option, redeem ordinary shares upon completion of business combination transaction subject to certain limitations. According to SPAC certificate of incorporation, the entity will not redeem its public shares in an amount that would cause SPAC net tangible assets (NTA) to be less than $5,000,001. SPAC will also redeem public shares if no business combination transaction takes place. Generally, the redemption value is aggregate amount held in the trust account at the time of the redemption including interest less related taxes.

A share redeemable at the option of the issuer or the holder, or which redemption is contingent on the occurrence or nonoccurrence of an uncertain event, does not meet the definition of a mandatorily redeemable instrument before the option is exercised or the event occurs. The above position is consistent with par. B25 of the Background Information and Basis for Conclusions of FASB Statement 150:

“Board considered whether to include within the scope of this Statement shares that could be redeemed – mandatorily, at the option of the holder, or upon some contingent event that is outside the control of the issuer and the holder. However, this Statement limits the meaning of mandatorily redeemable to unconditional obligations to redeem the instrument by transferring assets at a specified or determinable date (or dates) or upon an event certain to occur.”

Since ordinary public shares are redeemable at the option of the holder and upon occurrence of the merger or, mandatorily, in the event of liquidation (i.e. if no merger occurs), the shares are not considered mandatorily redeemable, from the ASC 480 perspective.

Similarly, a reporting entity does not have an unconditional obligation to repurchase warrants issuable under the terms of FSA. The warrants are not puttable at the option of the equity holders and, thus, not included in the scope of ASC 480 (ASC 480-10-55-33).

Overall, instruments issued under the terms of FSA are not considered mandatory redeemable per ASC 480. Generally, SPAC FSA does not meet requirements for other types of instruments described in ASC 480-10-25-14 and included in the scope of ASC 480.

Generally, SPACs classify public shares issuable under FSA as temporary equity, subject to certain redemption limitations stated in legal documents. Some respondents raised a question of whether SPAC’s classification of common stock as temporary equity in accordance with ASC 480-10-S99-3A would imply that an FSA will be subject to ASC 480. According to ASC 815-10-15-76, classification as temporary equity is considered consistent with equity classification per ASC 815-40-15 even though the underlying shares are presented outside of permanent equity. We believe that classification of underlying shares as temporary equity does not automatically result in the FSA agreement to be subject of ASC 480.

Box B2: ASC 815-40-15 includes the guidance analyzing if the instrument is indexed to entity’s own stock or indexation guidance. Generally speaking, instruments are indexed to entity’s own stock when economic characteristics and risk of the instrument are similar to those of entity’s equity.

Indexation guidance requires an entity to apply a two-step approach (ASC 815-40-15-7). Step 1 covers the evaluation of instrument’s contingent exercise provisions, if any. If the evaluation of Step 1 does not preclude an instrument from being considered indexed to the entity’s own stock, the analysis shall proceed to Step 2. Step 2 of the indexation guidance is focused on the analysis of instrument’s settlement provisions.

As part of Step 1, management should evaluate all contingencies or conditions associated with exercise of investor’s rights under the terms of the instrument. Settlement condition or a provision that affects whether contract is settled, such as occurrence of a merger transaction, is considered an example of exercise contingency.

An exercise contingency shall not preclude an instrument (or embedded feature) from being considered indexed to an entity’s own stock provided that it is not based on either of the following:

- An observable market, other than the market for the issuer’s stock (if applicable)

- An observable index, other than an index calculated or measured solely by reference to the issuer’s own operations (for example, sales revenue of the issuer; earnings before interest, taxes, depreciation, and amortization of the issuer; net income of the issuer; or total equity of the issuer).

A settlement condition linked to the change in control or merger involving the reporting entity is not based on an observable market or index. Therefore, such a settlement condition does not prevent equity classification.

As part of Step 2, management should evaluate all adjustments to instrument’s exercise price as well as the amount of issuable shares. Generally, settlement provisions will not preclude equity classification if the exchange terms are as such that fixed number of entity’s shares is exchanged for fixed monetary amount, i.e., fixed exercise price, subject to certain exceptions. The above rule is referred to as “fixed-for-fixed”.

Certain settlement adjustments impacting amount of issuable shares and settlement price may comply with Step 2 requirements. Example includes adjustments based on variables used as inputs to the valuation model utilized to determine the fair value of a fixed-for-fixed forward or option on equity shares (ASC 815-40-15-7E).

Analysis of settlement provisions applicable to FSA is conceptually similar to the analysis performed for SPAC’s private and public warrants. Following SEC statement issued on April 12, 2021, concerning the accounting of warrants, many SPACs determined that settlement terms of private and/or public warrants are inconsistent with equity classification requirements. Specifically, provisions of tender offer and related warrant cash settlement were as such that, under certain conditions, warrant holders appear to be entitled to a more favorable settlement than other stockholders would. The above disparity in settlement terms is inconsistent with equity classification requirements discussed in ASC 815-40-55-2 through 55-5. Additionally, certain inputs in the valuation of the cash redemption value were also inconsistent with the inputs used to determine the fair value of a fixed-for-fixed equity-linked instrument stated in ASC 815-40-15-7E through 15-7H.

If a reporting entity concluded that warrants issuable under the terms of FSA do not meet Step 2 equity classification requirements, the FSA is presumed not to meet Step 2 requirements either. Conversely, if a reporting entity concluded that warrants issuable under the terms of FSA meet Step 2 equity classification requirements, settlement terms of the warrants do not prevent classification of FSA as equity.

Next, reporting entities should determine if settlement terms of public shares issuable under FSA are consistent with Step 2 requirements. Generally, SPACs classify public shares as temporary equity, subject to certain redemption limitations stated in legal documents and consistent with the requirements of ASC 480-10-S99-3A. According to ASC 815-10-15-76:

“Temporary equity is considered stockholders’ equity for purpose of the scope exception in paragraph 815-10-15-74(a) even if it is required to be displayed outside of the permanent equity”.

Based on the above, classification of commons shares as temporary equity is consistent with Step 2 equity classification requirements for FSA.

Box B4: Generally, additional equity classification requirements are intended to identify situations when the instrument holder can force the issuer to settle in cash and not in equity. Additional equity classification requirements are as follows:

- Settlement is permitted in unregistered shares;

- Entity has sufficient authorized and unissued shares;

- Contract should contain an explicit limit on the number of shares to be delivered;

- No required cash payment if entity fails to make timely filings with SEC;

- No cash-settled top-off or make-whole provisions;

- No counterparty rights rank higher than shareholder rights;

- No collateral required;

Recently issued accounting updated ASU 2020-06 eliminated conditions one, six and seven. ASU 2020-06 is effective for smaller reporting companies for fiscal years beginning after December 15, 2023. Early adoption is permitted for fiscal years beginning after December 15, 2020, as the earliest.

We understand that, in general, the amount of authorized shares at the time of the IPO was determined as such that SPACs have enough unissued shares to satisfy their obligations under FSA agreement. In this case, requirement two above will be met. Overall, we understand that most SPACs will likely meet other applicable requirements, however, a careful analysis should be performed to corroborate that.

Box B5, B6: An FSA that receives an exception from derivative accounting is recorded within reporting entity’s equity. Equity issuance proceeds may have to be allocated to the instrument in question on a relative fair value basis. Subsequently, FSA is not remeasured and is carried at the initial amount.

FSA that does not qualify for equity classification pursuant to ASC 815 is classified as a liability (or asset). The instrument is measured at fair value initially and subsequently until the instrument expires or is settled. Fair value remeasurement adjustments are recorded in earnings. As part of initial recognition, reporting entities should allocate IPO proceeds to the liability-classified FSA, thus reducing equity proceeds as reported in company’s equity, i.e. additional paid-in capital.

Based on the above analysis, the key consideration that will determine equity or liability/asset classification and resultant measurement is the classification of warrants underlying the FSA. Liability-classified warrants likely result in liability-classified FSA, while equity-classified warrants do not prevent equity classification of the FSA.

Additional Considerations: Impact of ASC 815-40-55-13

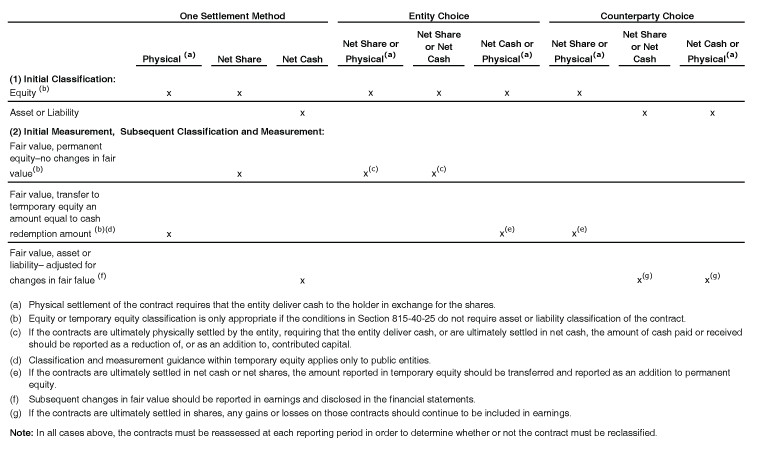

ASC 815-40-55-13 includes a table that provides guidance for accounting of a freestanding forward sale agreement depending on the type of relevant settlement methods. Settlement methods and related accounting options are presented in Appendix B Accounting for Forward Sale Contracts.

According to FSA, the sponsor (buyer) delivers the full stated amount of cash to SPAC (seller) and the SPAC delivers the full stated amount of units to the buyer. Therefore, only physical settlement method is allowed.

When the contract allows physical settlement only, GAAP indicates that the reporting entity should check the requirements of ASC 815-40-25 to see if the contract should be classified as a liability or equity. ASC 815-40-25, Contracts in Entity’s Own Equity, Recognition provides guidance on classification of derivative instruments as either liability or equity. The guidance specifically focuses on a) impact of cash settlement provisions and b) additional equity classification requirements. ASC 815-40-25 does not include indexation guidance covered in ASC 815-40-15.

Standard FSA agreements do not envisage cash settlement. If the above equity classification requirements are met, application of ASC 815-40-55-13 would result in FSA to be classified as an equity instrument.

Although literal reading of ASC 815-40-55-13 guidance does not involve application of derivative scope exception per ASC 815-40-15, existing accounting practice is that the scope exception is still analyzed (in addition to requirements in ASC 815-40-25) to determine classification of FSA. We support application of the indexation guidance as part of FSA analysis, absent further clarification from authoritative bodies.

Conclusions: SPAC forward sale agreements are likely to be considered freestanding equity-linked financial instruments. FSAs are likely not to be classified as assets or liabilities under ASC 480. FSA with an obligation to issue warrants properly classified as liabilities are not considered indexed to entity’s own stock. Such FSAs are classified as a liability or asset measured at fair value initially and subsequently through the date the contract is settled or expired. As part of initial recognition, reporting entities should allocate IPO proceeds to the liability-classified FSA, thus reducing equity proceeds as reported in company’s equity (additional paid-in capital).

FSAs with obligation to issue warrants property classified as equity are considered indexed to entity’s own stock. Reporting entities should analyze such FSAs to determine if they additional equity classification requirements including share sufficiency are met. Our understanding is that most FSAs would meet the equity requirements. If so, reporting entities should classify such FSAs as equity.

Analysis of Components of Forward Sales Agreements: Warrants, Common Stock, Sponsor’s Option

A typical SPAC FSA contains a number of components including the obligation to issue common stock, warrants both of which are considered equity-linked components. Once a reporting entity determines that an equity-linked component is embedded in a host instrument, it should evaluate whether the instrument should be (1) accounted for as a single, hybrid instrument, or (2) separated into the host instrument and the equity-linked component.

Box A: First step in this analysis is to determine if the warrants are considered freestanding or embedded. Warrants and common stock instruments are part of one FSA agreement and were not contracted for separately. Obligation to issue common stock and warrants are not legally detachable in a sense that both common stock and warrant are issued together. Therefore, warrants are not legally separable. The warrant component represents an embedded feature and not a freestanding instrument.

If the feature is considered embedded, it should be analyzed to determine if it should be bifurcated from the host instrument. That determination will involve evaluating the hybrid or compound instrument pursuant to ASC 815-15, Embedded Derivatives.

Box C1: ASC 825-10, Financial Instruments provides reporting entities with an option to measure many financial instruments at fair value on an instrument-by-instrument basis. ASC 825-10-15-5(f) precludes election of the fair value model for financial instruments that are, in whole or in part, classified by the issuer as a component of shareholder’s equity (including temporary equity). Therefore, if FSA was classified in entity’s equity, the fair value option does not apply.

Box C3: Clearly and closely related evaluation refers to a comparison of the economic characteristics and risks of the embedded feature and those of the host. US GAAP does not offer a specific definition of clearly and closely related concept, however, it illustrates the concept through examples provided in ASC 815-15-25-23 through 50.

Generally, to be considered clearly and closely related to the host, the underlying that causes the value of embedded feature to fluctuate, must be related to the inherent economic characteristics of the host instrument. To assess whether an embedded feature is considered clearly and closely related to the host, reporting entity should first determine the nature of the host contract.

As discussed in Box B5, B6, FSA as a freestanding contract may be classified as a liability or equity, predominantly based on the classification of underlying warrants. Since warrant classification is likely to be consistent with FSA classification, economic characteristics and risk of the warrants are likely to be considered clearly and closely related to those of FSA. In this case, obligation to issue warrants will not be accounted for separately from the FSA.

In cases when FSA will be classified as a liability, economic risk and characteristics of the obligation to issue common stock are likely not to be clearly and closely related to those of the host as the economic characteristics and risk of the common stock component are more closely aligned with equity instruments, not liability instruments. In this case further analysis of accounting for the common stock component is required.

Box C2: If the economic characteristics and risks of the embedded feature and the host are clearly and closely related to each other, ASC 815 does not require bifurcation of the feature from the host. FSA and embedded components are recorded as one instrument.

Box C4: This analysis concerns accounting for the commons stock component of FSA when the FSA is classified as a liability instrument. Generally, we believe that the common stock component will meet requirements of Step 1 and Step 2 indexation guidance. Additional analysis will have to be performed to determine if the component meets other equity classification requirements. The analysis will be based on the evaluation performed in relation to FAS as a whole (Box B4).

FSA also contains a sponsor option to purchase additional units at the specified price. Same price applies to potential purchase of additional and initial units. Sponsor’s option to buy additional units is similar to an overallotment option. Essentially, it represents a written options for additional securities.

The option should first be analyzed to determine if it is considered a freestanding or an embedded instrument. The option is freestanding if it can be transferred separately from the related units. Conversely, if sponsor’s option and related units cannot be separated, the option would be considered a feature embedded in the FSA host. Generally, sponsor’s option to purchase additional shares cannot be separated from the host and, therefore, is considered embedded.

Next, a reporting entity should analyze clearly and closely related criterion. Generally, we believe that the economic characteristics and risks of the embedded written call option are considered clearly and closely related to the economic characteristics and risks of the FSA host contract. Therefore, sponsor’s option would not have to be bifurcated from the FSA.

Conclusions: A typical FSA contains a number of components including the obligation to issue common stock, warrants and sponsor’s option to acquire additional units. All these components are considered embedded and not freestanding instruments. Reporting entities should analyze if the components should be bifurcated or accounted for as part of FSA host.

Economic characteristics and risk of warrant components are likely to be considered clearly and closely related to those of the host, regardless of classification of warrants as equity or liability. Therefore, warrant component is likely not to be bifurcated under ASC 815-15.

Common stock component is likely to be considered indexed to entity own stock. Reporting entity should perform additional analysis to determine if the component meets additional equity classification requirements. Our understanding is that common stock component of most FSAs would meet equity classification requirements. In these cases, ASC 815-15 does not require bifurcation of the feature from the host.

The economic characteristics and risks of sponsor’s option to acquire additional units are considered clearly and closely related to the economic characteristics and risks of the host contract. Therefore, sponsor’s option would not have to be bifurcated from the host instrument.

Reassessment Requirements

The reporting entity should reassess equity vs. liability classification of equity-linked instruments at the end of each reporting period (ASC 815-40-35-8 through 35-10). Similarly, an embedded components should be reassessed at the end of each reporting period to determine whether it should be separated or, if previously separated, whether it no longer meets separation requirements. However, an analysis of the clearly and closely related criterion is generally a onetime assessment.

Reclassification is often times triggered by changes in facts and circumstances relevant to FSA host, underlying warrants or common stock. For example, classification of warrants may change due to changes in the warrant terms. Meeting additional equity classification requirements and, specifically, share sufficiency requirement, may be impacted by issuance of company’s common stock.

If an FSA previously classified as equity no longer meets equity classification requirements, it has to be re-classified as an asset or a liability at its then current fair value. In this case, the instrument is remeasured at fair value subsequently with the changes recognized in earnings.

If an instrument previously classified as a liability or asset needs to be re-classified to equity, the instrument is recorded as part of entity’s equity at fair value on the reclassification date with no subsequent revaluation. Similarly, if a previously bifurcated embedded feature no longer meets bifurcation requirements, it is recognized as part of entity’s equity at instrument’s then current fair value.

There is no limit on the number of times an FSA may be reclassified.

Additional thoughts: look-through and instrument-level approaches

The complexity of accounting for SPAC FSA is largely driven by characteristics of underlying equity-linked components (warrants and commons stock), which need to be analyzed in addition to characteristics of the forward sale agreement. To streamline the above multi-level analysis, some reporting entities developed the following two accounting approaches:

1: evaluating only the FSA’s direct exercise and settlement provision (the FSA-level view) or

2: “looking through” to all direct and indirect exercise and settlement provisions (the look-through view)

As part of FSA-level view any exercise and settlement terms of underlying commons stock and warrants are disregarded as the analysis focuses on terms directly relevant to the FSA. All exercise and settlement terms relevant to FSA itself as well as the underlying components are analyzed as part of the look-through view.

Under the FSA-level view, SPAC FSAs are to be classified as equity instruments regardless of the classification of underlying warrants as the price at which SPAC is obligated to issue commons stock and warrants is generally fixed. As noted above, under look-through view some FSAs will be classified as liability or equity, mostly depending on the classification of the underlying warrants.

Although an approach that focuses on direct characteristics of the host may be appropriate in certain circumstances, generally, we believe that following a look-through approach to SPAC FSAs is preferable as the approach more comprehensively addresses all FSA relevant terms and conditions.

Appendix A

Accounting for Equity-Linked Instruments

Appendix B:

Accounting for Forward Sale Contracts