Impact of ASU 2020-06 on accounting for convertible debt

The impact of ASU 2020-06 is somewhat intertwined with existing (legacy) accounting for convertible debt instruments. The key question relating to accounting for convertible debt is how to account for the conversion feature embedded in debt sometimes referred to as “debt host”.

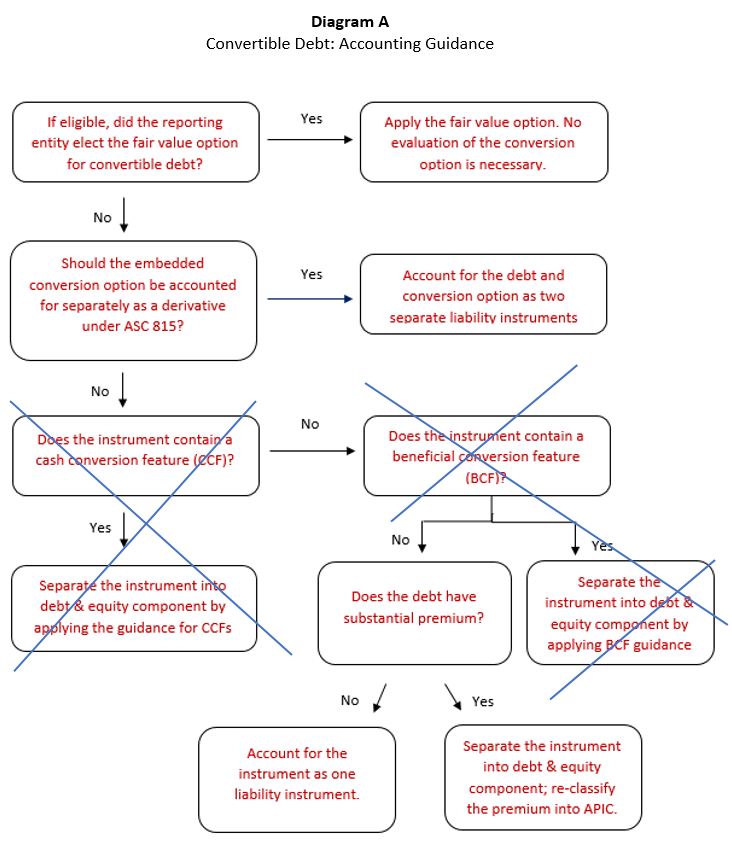

Under existing U.S. GAAP, a debtor first makes a determination if it is eligible and, if so, if it elects to account for debt at fair value. If the fair value option was elected, the debt and the embedded conversion option are reported as one liability instrument, measured at fair value.

If the fair value option cannot be or was not elected, the convertible debt may be accounted for under one of the following accounting guidance:

- Derivative Financial Instruments

- Cash Conversion Features (CFF)

- Beneficial Conversion Feature (BCF)

- Debt with Significant Premium

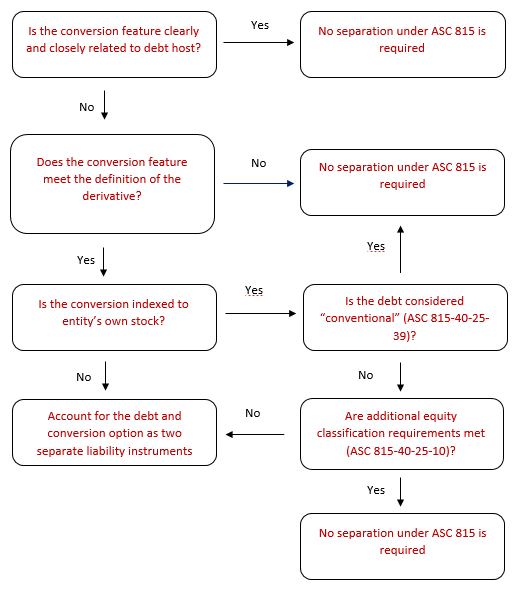

Accounting analysis is performed in the same order as accounting guidance is listed above, i.e. top down. Diagram A, Convertible Debt: Accounting Guidance illustrates application of existing accounting rules to convertible debt. Diagram B, Application of Derivative Accounting Guidance provides details on the application the derivative accounting under the existing guidance.

Note that the fair value option may not be elected for convertible debt that is subject to cash conversion guidance or debt that has beneficial cash conversion feature.

FinAcco publication Convertible Debt, issued in the series Complex Accounting Issues provides further details on the application of the existing accounting rules for convertible debt.

Removal of BCF and CFF models

New guidance removes accounting models for beneficial conversion features (BCF) and cash conversion features (CCF).

Under the revised guidance, the embedded conversion features is separated from the host contract only if the conversion feature:

- is required to be accounted for under Topic 815, Derivatives and Hedging, or

- results in substantial premiums accounted for as paid-in capital.

Topic 815 includes the criterion referred to as “clearly and closely” related as well as the scope exception from the derivative accounting. Therefore, according to the revised guidance, convertible instruments that continue to be separated are (a) those with embedded conversion features that are not clearly and closely related to the host contract, that meet the definition of a derivative, and that do not qualify for a scope exception from derivative accounting and (b) convertible debt instruments issued with substantial premiums for which the premiums are recorded as paid-in capital.

Consistent with the existing guidance, the revised guidance allows entities to elect the fair value model under which the combined instrument will be measured at fair value with changes in the value reported in earnings.

Overall, the new accounting guidance provides notably simpler accounting model as compared to the existing model. Given the removal of BCF and CCF accounting models, more conversion features will be accounted for as part of debt host and not separately.

The impact of the new accounting guidance is reflected in Diagram A by crossing off parts of the existing accounting guidance which were eliminated by ASU 2020-06.

Additional Equity Classification Requirements

As part of the application of derivative framework, a reporting entity applies the definition of the derivative financial instrument to the instrument in question. The reporting entity also performs an analysis to determine whether a contract meets the scope exception from derivative accounting per ASC 815-10-15-74. The scope exception analysis includes two criteria:

- the contract is indexed to an entity’s own stock; and

- the contract is equity classified.

New standard did not introduce any substantial changes to first criterion referred as indexation guidance. FASB introduced certain simplification to the analysis of whether the contract is classified as equity.

The underlying premise of the accounting for convertible debt is that cash-settled conversion features are considered liability instruments reported separately from debt host. According to ASC 815-40-25-2, “…if the contract provides the entity with a choice of net cash settlement or settlement in shares, this Subtopic assumes settlement in shares.” However, not all share-settled contracts qualify for equity classification.

For a share-settled contract to be classified as equity, it should meet each of the additional seven classification conditions specified in ASC 815-40-25-10. Generally, additional equity classification requirements are intended to identify situations when the debt holder can force the debt issuer to settle in cash and not in equity.

Seven additional equity classification requirements are as follows:

- Settlement is permitted in unregistered shares;

- Entity has sufficient authorized and unissued shares;

- Contract should contain an explicit limit on the number of shares to be delivered;

- No required cash payment if entity fails to make timely filings with SEC;

- No cash-settled top-off or make-whole provisions;

- No counterparty rights rank higher than shareholder rights;

- No collateral required;

Condition 1 is based on the assumption that a public company is unable to control all events or actions required to main an effective registration statement. For example, a registrant cannot control whether an auditors will provide the audit opinion or consent required for a registration statement. Therefore, under the existing guidance, if the contract requires settlement in registered shares, equity classification is generally disallowed.

The idea behind condition 6 is that a contract cannot give the counterparty any of the rights of a creditor in the event of the entity’s bankruptcy.

Regarding condition 7, a contract requirement to post collateral of any kind by the issuer would preclude equity classification because a requirement to post collateral is inconsistent with the concept of equity.

New accounting guidance removes requirements 1, 6 and 7.

Regarding condition 4, FASB has clarified that penalty payments arising from the failure to timely file, do not preclude equity classification.

Other Changes

Under the existing guidance in ASC 815-40, FASB used the term conventional convertible debt to distinguish which instruments are eligible to apply a simplified assessment of the settlement criterion related to the derivatives scope exception (ASC 815-40-25-39). FASB concluded that the word “conventional” is not considered necessary and meaningful and, therefore, decided to remove it from the guidance. However, the above change did not have any substantial impact on the separation guidance as FASB retained simplified analysis applicable to certain convertible debt instruments in ASC 815-40-25-39 through 42 consistent with the existing guidance.

Under existing ASC 815-40-35-8, the classification of a contract as equity or liability/asset shall be reassessed at each balance sheet date. The new accounting guidance has clarified that the above reassessment guidance applies to both freestanding instruments and embedded features.

The impact of the new accounting guidance is reflected in Diagram B by underlining parts of the existing accounting guidance modified by ASU 2020-06.

Effective Date and Transition

The new guidance is effective for SEC filers, excluding smaller reporting companies as defined by the SEC, for fiscal years beginning after December 15, 2021. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2023. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020.

New guidance can be adopted by following either a modified retrospective method or a fully retrospective method of transition. In applying the modified retrospective method, entities should apply the guidance to transactions outstanding as of the beginning of the fiscal year in which the amendments are adopted. The cumulative effect of the change should be recognized as an adjustment to the opening retained earnings at the date of adoption. Under the fully retrospective method of transition, a reporting entity recognizes the cumulative effect of the change as an adjustment to the opening retained earnings in the first comparative period presented.

FASB allowed all entities to irrevocably elect the fair value option in accordance with Subtopic 825-10, Financial Instruments, for any convertible debt security upon adoption of the revised guidance.

Diagram-A

Diagram-B

Important Note: FinAcco Consulting LLC is not responsible for, and no person should rely upon, any advice or information presented on this website. Note that entity’s financial statements, including, without limit, the use of generally accepted accounting principles (“GAAP”) to record the effects of any proposed transaction, are the responsibility of management. Therefore, any written comments by FinAcco Consulting LLC about the accounting treatment of selected balances or transactions or the use of GAAP are to serve only as general guidance. Our comments are based on our preliminary understanding of the relevant facts and circumstances and on current authoritative literature. Therefore, our comments are subject to change. FinAcco Consulting LLC does not assume any responsibility for timely updates of its website overall or any information provided in the Insights section of the website, specifically.