SPAC Accounting Issues

Background

SPAC or a special purpose acquisition company is a shell company listed on a stock exchange with the purpose of acquiring a private company and, therefore, making it public without going through the traditional IPO process. SPAC process differs from tradition IPO in a way that the target that eventually becomes the public company is not involved in SPAC’s formation and IPO. Financial compensation of SPAC sponsors and managers is as such that they have a strong incentive to identify and merge with the target.

To close the acquisition, SPAC must meet substantial reporting requirements relating to the target. One of the most substantial requirements is provision of financial statements prepared under US GAAP and SEC reporting requirements and audited under PCAOB standards. The financial statements should be for at least two most recent fiscal years or since inception.

SPAC Accounting for Warrants

Refer to FinAcco’s publication SPAC: Measurement and Classification of Warrants.

Note that a warrant on redeemable shares is considered a liability instrument included in the scope of ASC 480 (ASC 480-10-55-33). Redeemable shares include mandatorily redeemable shares as we all as shares puttable at the option of the holder.

Earnings per Share: Two-Class Method

Entities that have multiple classes of common stock are required to use the two-class method in calculation and presentation of earnings per share (EPS) information. The method should also be used when an entity issued other securities participating in dividends or so-called participating securities.

As part of the two two-class method, EPS is calculated for each class of common stock and participating security. To calculate respective EPS numbers, an entity should allocate its earnings between more than one class of securities. ASC 260-10-45-60B(d) requires separate presentation of both basic and diluted EPS for each class of common stock. Entities are allowed but not required to present EPS numbers for participating securities other than common stock (ASC 260-10-45-60).

Application of the two-class method involves the following three steps (ASC 260-10-45-60B):

Step 1, Dividend Allocation: Net income shall be reduced by the amount of dividends declared in the current period for each class of stock and by the contractual amount of dividends that must be paid for the current period.

Step 2, Earning Allocation: The remaining earnings shall be allocated to common stock and participating securities to the extent that each security may share in earnings as if all of the earnings for the period had been distributed.

Step 3, EPS Calcs: the total earnings allocated to each security as part of Step 1 and 2 shall be divided by the number of outstanding securities to which the earnings are allocated to determine the EPS for security.

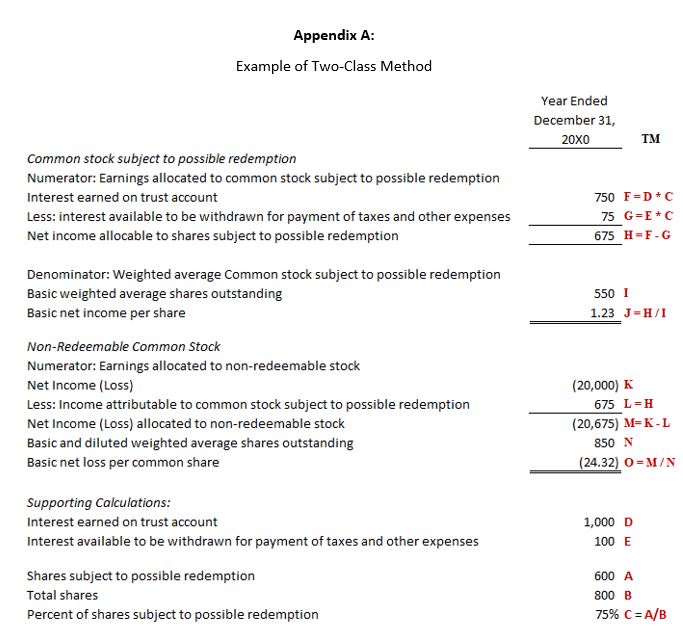

Many SPACs have to calculate EPS separately for redeemable and non-redeemable shares. If shares are redeemed, current period earnings available for distribution equal to interest income reduced by applicable income taxes and other eligible expenses. Generally, potential redemption will be pro-rata to all common stock issued and outstanding, not just redeemable commons stock. Earnings allocated to potentially redeemable shares are calculated as gross interest less applicable expenses multiplied by the ratio determined as follows: amount of potentially redeemable shares divided by total common shares as of period end. Earnings allocated to non-redeemable common shares are determined as net earning for the period less earnings allocated to redeemable shares. Appendix A, Example of Two-Class Method illustrates application of the two-class method to calculations of basic EPS assuming no dividends were declared or contractually due.

Although presentation of basic and diluted EPS for participating securities other than common stock is not required, such securities impact allocation of earnings to common stock and, therefore, EPS disclosed in entity’s financial statements.

More guidance on participating securities and undistributed earnings is included in ASC 260-10-55-24 through 55-31.

Summary: Basic and diluted EPS have to be calculated and disclosed for each class of common stock using the two-class method. Application of the method requires allocation of earnings to each class of commons stock. SPACs calculate and disclose EPS for shares subject to redemption and non-redeemable common stock.

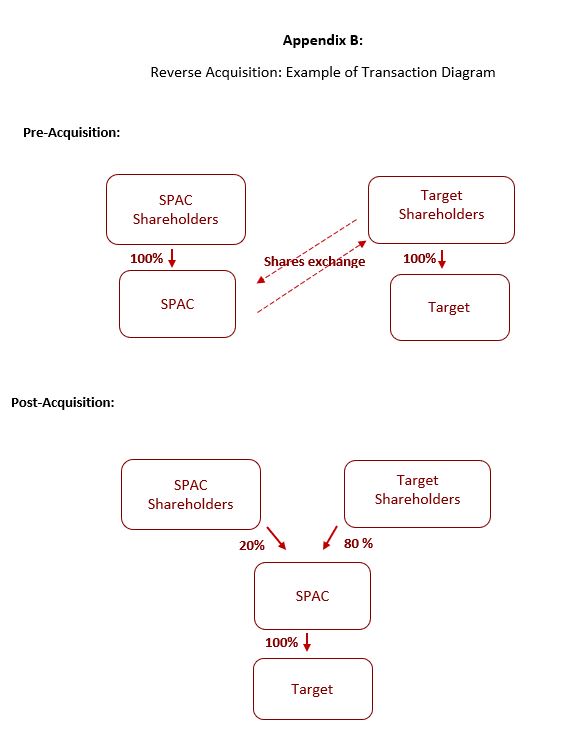

Acquisition Close- Accounting for Reverse Acquisition

Merger with target is often structured as a reverse acquisition. A reverse acquisition occurs if the legal acquirer or the entity that issues securities is identified as the acquiree for accounting purposes and the entity whose equity interests are acquired or the legal acquiree is the acquirer for accounting purposes. Generally, shareholders of the accounting acquirer become controlling shareholders of the combined entity. Appendix B Reverse Acquisition: Example of Transaction Diagram reflects general terms of a reverse acquisition transaction.

As part of applying acquisition accounting, a determination will need to be made if the SPAC or the target is considered the accounting acquirer, from the US GAAP perspective.

The accounting acquirer is the entity that has obtained control of another entity, the acquiree. The determination of the acquirer involves examination of a number of factors especially in instances when the purchase consideration issued to execute the acquisition consists of a mix of cash and equity or all-equity. Specifically, management team will need to evaluate relative voting rights, structure of the board of directors, management, comparative size of combining entities, other terms and conditions of the equity exchange. Determination of the acquirer is particularly important, as it impact the accounting including potential fair value adjustments and financial statement presentation.

If a SPAC is determined to be the accounting acquirer, the fair value of target’s assets and liabilities are recognized in accordance with ASC 805, Business Combinations. If, instead, the target is determined to be the accounting acquirer, the merger is considered to be a capital transaction and not a business combination as the SPAC, being the company without substantial operations may not be considered a business as defined in ASC 805-10-55-3A. The only asset the SPAC has before the merger is likely to be cash obtained from sponsors and other investors.

Many merger transactions involving SPACs are structured in a way where the target is considered the accounting acquirer (legal acquiree) and SPAC is considered the accounting acquiree (legal acquirer).

Following the merger, legal capital of the combined entity reflects the capital of the legal acquirer, not accounting acquirer. Legal capital reflects structure or classes of shares issued and outstanding, amount of such shares by class as well as their nominal or par value. Legal capital of the combined entity is retroactively adjusted to reflect the impact of the merger. The adjusted share capital is determined by taking historical or pre-merger amounts of shares issued and outstanding by the target and multiplying them by the shares exchange ratio. Following the example presented in Appendix B, the exchange ratio is determined as follows:

(amount of shares issues by SPAC as part of the transaction) / (amount of shares tended by target shareholders).

ASC 805-40, Reverse Acquisitions provides further accounting requirements relevant to reverse acquisitions.

Summary: if the merge with the target is structure as a reverse acquisition, management needs to determine accounting acquirer and acquiree, from the US GAAP perspective. If operations of the acquiree, i.e., acquired operations constitute a business, its assets and liabilities need to be measured at fair value consistent with requirements of ASC 805, Business Combinations. Following the transaction, legal capital of the combined entity reflects the capital of the legal acquirer, not accounting acquirer. Legal capital of the combined entity is retroactively adjusted to reflect the impact of the merger.

Important Note: FinAcco Consulting LLC is not responsible for, and no person should rely upon, any advice or information presented on this website. Note that entity’s financial statements, including, without limit, the use of generally accepted accounting principles (“GAAP”) to record the effects of any proposed transaction, are the responsibility of management. Therefore, any written comments by FinAcco Consulting LLC about the accounting treatment of selected balances or transactions or the use of GAAP are to serve only as general guidance. Our comments are based on our preliminary understanding of the relevant facts and circumstances and on current authoritative literature. Therefore, our comments are subject to change. FinAcco Consulting LLC does not assume any responsibility for timely updates of its website overall or any information provided in the Insights section of the website, specifically.