Practical IPO Guide

IPO Activities

Going public is a complicated, transformative, and time-consuming process. It requires careful planning and mobilization of company’s resources. Generally, IPO planning starts 12 to 20 months prior to the expected transaction close date.

The key activities concerned with making an entity a public company include:-building IPO team;

- determining IPO structure;

- determining filer status;

- dealing with accounting issues;

- preparing registration statement;

Following the IPO, the company will be expected to meet ongoing listing requirements as well as expectations of stakeholders of a publicly traded company. Activities helping company to be a public company include upgrading or sustaining financial reporting capabilities, creating an investor relations function, improving financial planning and analysis, among others.

Building IPO Team

An IPO team includes the following parties:

- underwriter;

- company personnel;

- legal (securities) counsel;

- accounting advisors;

- independent auditors;

- financial printer;

Company personnel will need to provide the necessary information used to prepare the registration statement. Personnel should also be actively involved in all important aspects of the registration process.

Roles and responsibilities of team members will likely vary depending on the IPO structure.

Determining IPO Structure

IPO structures include the following:

- Traditional

- Direct listing

- Up-C

- SPAC merger

In a traditional IPO, there is an underwriter-led book building process and a commitment to sell a specific number of shares for a fixed initial public offering price negotiated with underwriters. Underwriters are compensated on a commission basis, which varies between 4-6% of the raised capital.

Unlike a traditional IPO, direct listing (DL) is executed without a traditional underwriter, i.e., an intermediary (re-seller) between the company and the buy-side. From this perspective, the company sells shares directly to the public. However, a DL still requires a financial advisor, hired independently by the company. Financial advisors are market makers and members of NYSE or NASDAQ. The advisor helps a company define listing objectives, consults on the registration statement, etc.

No new shares are issued as part of DLs and the shares offered for trading were previously issued through private placements, such as Regulation A or D offerings. Although DLs do not result in any dilution to existing shareholders, the shareholders provide liquidity on day one and beyond to facilitate trading. Generally, DLs are less expensive than traditional IPOs.

In Up-C structure public investors invests in a newly formed company (PubCo) that uses the IPO proceeds to acquire equity interest in an operating pass-through entity (e.g., partnership). At the time of the IPO, pre-IPO owners have their direct economic interest in the pass-through.

Post-IPO, original investors can either continue holding their direct interests in the pass-through or choose to either a) liquidate their investment for cash or b) exchange units for PubCo publicly traded stock. Redemption or exchange transactions are subject to separately signed exchange agreement.

Advantages of the Up-C structure include tax benefits provided to original investors through their investment in a pass-through while also providing liquidity offered by a traditional IPO.

SPAC or a special purpose acquisition company is a shell company listed on a stock exchange with the purpose of acquiring a private company and, therefore, making it public without going through the traditional IPO process. SPAC process differs from tradition IPO in a way that the target that eventually becomes the public company is not involved in SPAC’s formation and IPO.

SPAC itself is a publicly traded company and, therefore, general public can buy SPAC’s shares before the merger or acquisition takes place. Generally, SPACs are taken public through a traditional IPO. Following the IPO, SPAC founders or sponsors hold approximately 20% of SPAC’s voting shares. The sponsors benefit from the SPAC merger by having the opportunity to acquire equity interest of the combined company at nominal prices.

In any IPO structure, the company will be required to satisfy relevant stock exchange listing and governance requirements.

Determining Filer Status

Filers can be classified as:

- Foreign private issuers (FPIs) or domestic issuers;

- Emerging Growth Company (EGC) or non-EGCs;

- Smaller reporting company (SRC) or non-SRC;

For more information concerning FPIs refer to a separation section.

Companies can qualify as an Emerging Growth Company or EGC according to the JOBS Act enacted on April 5, 2012 (the Act).

A company is considered an EGC if a) its total annual gross revenue for the most recently completed fiscal year is less than $1.07 billion, b) it has not issued more than $1 billion of nonconvertible debt over the past three years and c) its public float, following the IPO, is less than $700 million as of the last business day of its most recently completed second fiscal quarter.

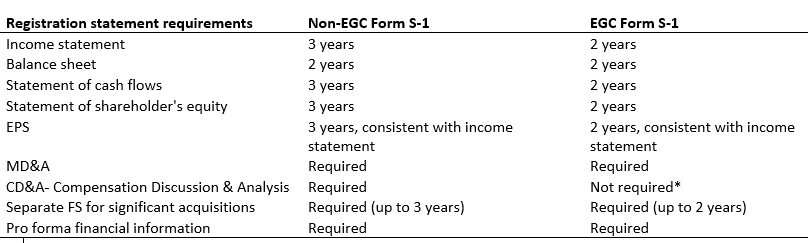

EGCs are allowed to:

- present statements of operations, cash flows and shareholders’ equity in audited financial statements for 2 years, not 3 years as non-EGCs should.

- defer auditor attestation on internal control SOX 404(b) for as long as the company is an EGCs.

- adopt new accounting standards on the same date as private companies have to adopt.

- apply certain exemptions to executive compensation disclosures.

For more information refer to Appendix A. Both domestic issuers and FPIs can qualify to be EGCs. The Act applies to EGCs for up to a maximum of five years.

A registrant may qualify as an SRC on the basis of either public float test or revenue test.

Because a company undertaking an IPO has a public float of zero, it will typically qualify as an SRC if it had annual revenues of less than $100 million in its most recent fiscal year.

SEC filing requirements for SRCs are significantly scaled back from those for larger companies.

Similarly to EGCs, SRCs should only disclose two years of audited financial statements in a registration statement.

SRCs are also not required to provide:

- Compensation Discussion & Analysis (Reg. S-K, Item 402);

- Unaudited quarterly financial information (Reg. S-K, Item 302);

- Qualitative and quantitative information about market risk (Reg. S-K, Item 305);

- Description of policies for the review and approval of related-party transactions (Reg. S-K, Item 404)

- Supplemental financial statement schedules

A company may qualify as both an SRC and an EGC.

Dealing with Accounting Issues

Common accounting issues encountered while preparing the registration statement include:

– segment reporting, i.e., disclosure of information included in the internal reporting package provided to the chief operating decision-maker (CODM) as required by ASC 280;

– revenue recognition, including application of Step 1 through 5 guidance and meeting disclosure requirements applicable to public entities per ASC 606;

– leases including lessee’s reporting of most leases on a “gross” basis, i.e., reporting lease liability and right-of-use assets and related disclosures per ASC 842;

– earnings per share (EPS) calculations including use of the two-class method applicable to more complex capital structures per ASC 260;

– financial instruments including liability versus equity classification applicable to warrants, convertible debt, preferred stock as detailed in ASC 480, ASC 815-40;

– non-GAAP measures and KPIs consistent with requirements of item 10(e) of Regulation S-K and Regulation G including a quantitative reconciliation of a non-GAAP measure to the most directly comparable GAAP measure.

Preparing Registration Statement

Financial statements (F-pages) prepared in accordance with U.S. GAAP and Reg. S-X include the following:

- Primary forms: balance sheet, statements of income, cash flows and changes in shareholder’s equity;

- Footnotes to the financial statements;

Other parts of the registration statement statements include description of risk factors, use of proceeds, MD&A, dilution, among others.

Age of financial statements (Reg S-X, Rule 3-12):

- Audited financial statements in an IPO filing must not be more than 134 days old;

- Third-quarter financial statements are considered “timely” through the 45th day after the most recent fiscal year-end*;

*After the 45th day, audited financial statements for the recently completed fiscal year must be included.

Interim financial statements:

- Interim financial statements are required If non third quarter financial statements go stale.

- Interim financial statements can be presented in a condensed format and are not audited.

- A review of the interim financial statements is typically performed by the company’s auditors.

Foreign Private Issuers (FPIs)

A non-U.S. issuer is considered an FPI unless certain disqualifying conditions are met. The conditions cover citizenship or residence of company’s controlling shareholders, directors and /or location of company’s assets (see SEC FRM, Section 6100).

An FPI status has certain benefits. Specifically, FPIs are not subject to:

- quarterly reporting on Form 10-Q or current reports on Form 8-K;

- reporting requirements relevant to executive compensation under Reg. S-K Item 402 and Reg. FD;

- requirement to disclose selected supplementary financial information related to quarterly financial data under Reg. S-K Item 302;

FPIs may file financial statements in US GAAP or IFRS as issued by the International Accounting Standards Board, or even local GAAP reconciled to US GAAP.

FPIs seeking listing on a U.S. stock exchange use Form F-1. Form 20-F is used as a subsequent annual report. Annual reports of FPIs are due 120 days after fiscal year end. Note that certain requirements on Form F-1, including requirement to provide specific financial information, are presented in form of references to requirements as listed on Form 20-F.

A registration statement of an FPI may become effective with annual audited financial statements as old as 15 months provided the most recent interim unaudited statements are as old as nine months. If interim audited financial statements are required, they must cover a period of at least 6 months as well as comparative period of the prior year. However, the requirement for comparative balance sheet information may be met by presenting the year-end balance sheet (Item 8.A.5 in Form 20-F). Interim financial statements are not required if annual audited financial statements are within nine months of the effective date of a registration statement.

For example, FPI’s annual audited financial statements as of 12/31/20X2 will become staled after 9/30/20X3. Such annual financial statements can be supplemented by interim unaudited financial statement for 6 months as of 6/30/20X3 with comparative information for 6 months as of 6/30/20X2. In this case, the financial information will become stale after 3/31/20X4, i.e., 15 months after 12/31/20X2.

Overall, the financial information of FPIs goes stale more slowly than U.S. issuers.

PFI may qualify as an Emerging Growth Company (EGC) and, if it does, apply the requirements applicable to EGCs.

PFIs are subject to Section 404 of 2002 Sarbanes-Oxley Act.

How FinAcco Can Help

FinAcco can assist you with the following IPO related tasks:

- Resolving accounting issues

- Addressing audit requests

- Preparing financial statements

- Preparing other parts of company’s S-1, as agreed with management

Generally, accounting advisors can assist with the following other parts company’s S-1:

- Pre and post-IPO capitalization information (par. 3430.2 of SEC FRM)

- Dilution table (Item 506 of Regulation S-K)

- MD&A covering results of operations, liquidity and capital resources, critical accounting policies and estimates (Item 303 of Regulation S-K)

Following the IPO, we can assist with meeting ongoing obligations as a public company, including:

- Ongoing compliance with Section 404 of Sarbanes-Oxley;

- Post-transaction technical accounting advice;

- Assistance with timely completion of audit and review procedures;

- Preparation of financial statements included in Forms 10-Q and 10-K;

Appendix A Reporting Requirements: EGC vs. non-EGS

Appendix A Reporting Requirements EGC vs. non-EGS

* EGS should still provide certain executive compensation disclosures per Item 402, “Executive Compensation” of Reg. S-K.

Important Note: FinAcco Consulting LLC is not responsible for, and no person should rely upon, any advice or information presented on this website. Note that entity’s financial statements, including, without limit, the use of generally accepted accounting principles (“GAAP”) to record the effects of any proposed transaction, are the responsibility of management. Therefore, any written comments by FinAcco Consulting LLC about the accounting treatment of selected balances or transactions or the use of GAAP are to serve only as general guidance. Our comments are based on our preliminary understanding of the relevant facts and circumstances and on current authoritative literature. Therefore, our comments are subject to change. FinAcco Consulting LLC does not assume any responsibility for timely updates of its website overall or any information provided in the Insights section of the website, specifically.